DataPath and Health-E Commerce join forces to enhance FSA and HSA user experience with frictionless technology solutions

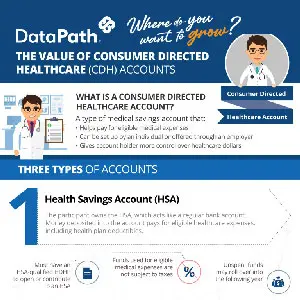

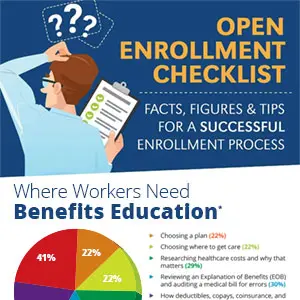

DataPath, Inc., announced today a new partnership with Health-E Commerce®, the parent brand of FSA Store® and HSA Store®, to offer benefit participants easy access to online shopping, account balance information, and direct payment options for their tax-free healthcare accounts.