FSA Contribution Limits

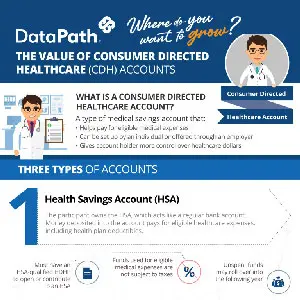

The Internal Revenue Service (IRS) recently announced updated FSA annual contribution limits. An important part of consumer-directed healthcare, FSAs offer participants a way to save on taxes while setting aside money for out-of-pocket healthcare expenses for themselves and their families.