What is an ICHRA? 5 Questions Employees Have About ICHRAs

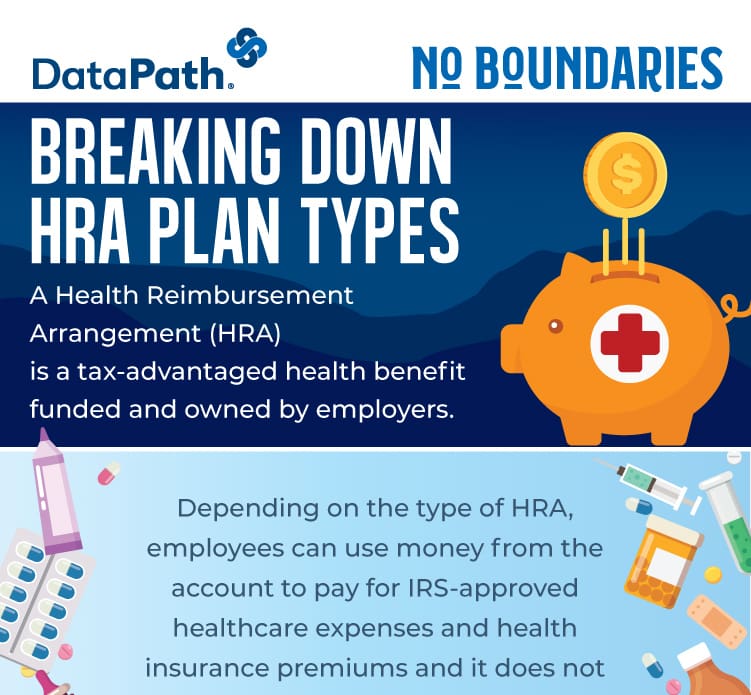

Most healthcare consumers know about Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These popular healthcare benefit accounts allow individuals and families to cover out-of-pocket healthcare costs by setting aside money before taxes are taken out. There are rules about account eligibility, contribution limits, and more. Plus, the funds must be spent on IRS-approved healthcare products. If they spend funds on ineligible items and services, account holders could face taxes or penalties. These accounts