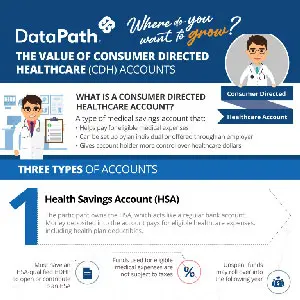

The Value of a Consumer Directed Healthcare Account

View the infographic below to discover the value of consumer-directed healthcare accounts. The graphic features an overview of HSAs, HRAs, and FSAs, along with other helpful information. What is a Consumer Directed Healthcare Account? A consumer-directed healthcare account is a type of medical savings account that: CDH Account Types 1. Health Savings Account (HSA) The participant owns the HSA, which acts like a regular bank account. Money deposited into the account pays for eligible healthcare