How Does Medicare Affect HSA Usage?

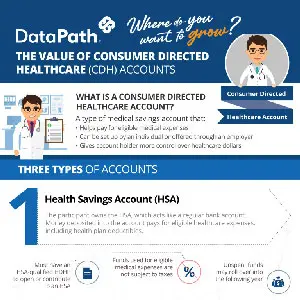

Qualified High Deductible Health Plan (HDHP) participants can use Health Savings Accounts (HSAs) to help cover their deductible responsibility. But what happens when they become eligible for Medicare? Medicare Basics Medicare is a federal health insurance program for those aged 65 and older as well as younger Americans with certain disabilities or End-Stage Renal Disease. Each of Medicare’s four parts offers a different type of coverage: HSA Basics An HSA is a tax-advantaged benefit that