Benefits can determine a company’s success or failure in competing for and holding on to engaged, productive workers. Whereas employers once boasted about their health and retirement benefits, those now serve as simply the foundation for a more complex benefits program needed for remote and hybrid/onsite workers.

If we learned anything from the Great Resignation of 2021-2022, it’s that employees need and are demanding more support from employers in terms of their physical, mental, emotional, and financial well-being.

Remote working is now an integral part of American workforce culture. With it comes the reality that employers have to compete in a much larger arena to attract, engage, and retain top talent. At the same time, they have a wider pool of potential employees from which to draw.

That compounds the challenge because the benefit needs of remote and hybrid/onsite workers are often not the same. Fully remote employees tend to use benefits differently than their hybrid/onsite colleagues.

Offering a competitive package that provides for that differential helps encourage current employees to stay and prospective employees to come aboard.

Remote Working Continues to Grow

In their 2022 State of Remote Work report, Owl Labs observed that 31% of American companies now offer a full-time remote option. Nearly as many – 29% – offer a hybrid option requiring employees to come onsite between one and four days each week. Another 30% require exclusively onsite work.

The career site Ladders estimates that 25% of professional jobs in North America had become remote by the end of 2022 and they expect that percentage to continue growing.

The positive impact on employers of having a remote workforce extends far beyond the potential cost savings of not having to maintain traditional workspace. More findings from the Owl Labs report:

- 57% of employees say that working independently in a remote location is more productive, while only 30% prefer doing solo work in the office

- About half (51%) say they think more creatively when remote, versus 30% who prefer creative thinking in the office

- Nearly half (49%) say they can focus better in a remote location, while 39% think they can do better in the office

- Nearly half (49%) say they can meet deadlines better when working remotely

Employee Satisfaction with Benefits Packages

Employee benefits packages are among the many business practices changed permanently by the pandemic. The needs of remote workers are in some ways different than those who report to a common worksite.

Employee satisfaction with their benefits fell to 61 percent in Met Life’s annual U.S. Employee Benefit Trends Study for 2023 – the lowest recorded in the past decade. A recent finding by Paychex that 55% of companies have not updated their benefits package since changing to remote work could have something to do with that.

The impact of not updating benefits packages can be seen in additional findings from the Paychex survey:

- 88% of respondents had been satisfied with their benefits package before going remote, but that dropped to 71% after they had switched to remote working and dropped again, to 65%, for those whose companies had not updated the benefits package since going remote

- 64% of employees whose companies updated the benefits package after going remote have no plans to leave within the next year, compared to 47% of those whose benefits have not changed

Benefit Priorities

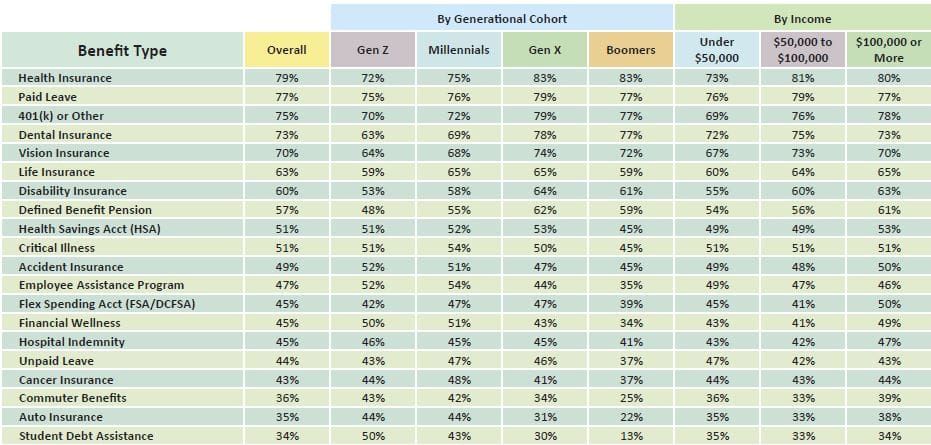

In The Advantages of Employee Care, their annual U.S. Employee Benefit Trends Study for 2023, MetLife reports the following percentages of employees who consider the listed benefit as a “must have.”

When asked which additional benefits they most wanted, respondents in the 2022 Paychex survey, regardless of age or rank, listed a home office stipend (31%) and an internet access stipend (30%) as their top two choices.

Gen X and Gen Z identified a home office stipend as their most-wanted additional benefit in response to working remotely. The top priority for Millennials was a stipend for internet access.

Having a practical and attractive home office can impact everything from the employee’s family life and home value to their productivity and professional appearance. Internet access, which can cost $600 annually or more, is normally required for remote employees.

As opposed to a home office or internet stipend, the top desire for Baby Boomers was a four-day workweek. Many respondents actually reported needing fewer hours to complete work assignments due to increased productivity after becoming remote.

In a 2022 survey by Qualtrics, 92% of respondents would prefer a four-day workweek, and 72% would favor it even if it meant working longer hours (such as four 10-hour days) on days they worked.7

Effective Benefits Options for Remote and Hybrid/Onsite Workers

The good news is that many of these “must haves” and perk preferences can be addressed by including as few as six particular options in the company’s benefits program.

Individual Coverage Health Reimbursement Account (ICHRAs)

An alternative option to group health coverage is to provide an Individual Coverage Health Reimbursement Arrangement or ICHRA, which addresses the must-haves of health insurance and hospital indemnity.

Under terms of an ICHRA, employees obtain their own health insurance coverage and are reimbursed by the employer for monthly premiums (up to a specified maximum). The individual policy must meet Minimum Essential Coverage (MEC) as mandated by the Affordable Care Act (ACA).

ICHRA plans effectively address provider network differences from one area of the country to another. In addition to giving employees more choices in their healthcare coverage, ICHRAs may also produce cost savings for employers.

Lifestyle Spending Accounts (LSAs)

Lifestyle spending accounts, or LSAs, provide employers with an effective tool in their efforts to address differing workforce needs and interests. Although around for some time, LSA popularity has soared in recent years. By offering LSAs, employers can address must-haves and perk preferences including employee assistance program services, financial wellness, auto insurance, and assistance with internet access and home office expenses.

LSAs can pay or reimburse for nearly any type of expense deemed eligible by the sponsoring employer, up to any maximum amount annually set by the employer. The accounts are employer-funded and taxable to the employee.

Companies use LSAs to address physical, mental, emotional, and financial well-being. They can include products, services, and activities in one specific area or multiple areas. Eligible expenses are often chosen from among the following options:

In addition to addressing several of the must-have benefits identified by MetLife, LSAs can be used for other often-requested benefits such as professional and career development activities.

Health Savings Accounts (HSAs)

Offering an HSA for employees enrolled in HSA-eligible healthcare coverage can address three employee must-haves, including health savings accounts, retirement (401k), and financial wellness.

As a healthcare account, the HSA provides triple-tax savings, including tax-free contributions, tax-free withdrawals for qualified healthcare expenses, and tax-free balance growth through interest and investment. As a retirement account, the HSA holds an advantage over 401(k) accounts. Funds can be withdrawn from an HSA tax-free for qualified healthcare expenses at any time during the account owner’s lifetime, whereas with a 401(k), withdrawals for any purpose are taxed at the owner’s current tax rate (plus an early withdrawal penalty, if not yet 65 years old).

In terms of financial wellness, the HSA provides tax savings of as much as 30-40% on funds contributed to the account (increasing take-home pay by up to hundreds or thousands of dollars annually) and provides a convenient vehicle for payroll deducted savings.

Flexible Spending Accounts, including Healthcare and Dependent Care FSAs

Healthcare FSAs help employees save taxes on qualified medical expenses. Dependent Care FSAs, also known as Dependent Care Assistance Plans (DCAPs), help save taxes on care of qualified tax dependents. Together, they can be used to help address the must-haves of flexible spending accounts and financial wellness.

Healthcare FSAs involve setting aside pre-tax funds from each payroll for use in paying out-of-pocket medical expenses not covered by insurance, such as co-pays, deductibles, co-insurance, prescriptions, and over-the-counter drugs. Depending on their tax bracket, employees can save up to 30-40% in taxes on the amount set aside for this purpose.

Dependent Care FSAs work in much the same way, except that the funds are used to pay for care of children and elderly dependents unable to care for themselves while the taxpayer is at work. Again, employees can save up to 30-40% in taxes on the amount set aside.

In addition to employee tax savings, employers save SSI/Medicare tax-matching expense on the amounts that their employees set aside.

Student Loan Repayment Assistance (SLRA)

Many employees are burdened by high student loan debt. Employers can address this area of employee must-have benefit priorities, as well as the more general priority of financial wellness, by offering an SLRA.

Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020, employer SLRA payments are not taxable to the employee but remain a business expense write-off for the employer. Through 2025, employers can make up to $5,250 annually, matching employee student loan debt payments.

Schedule Flexibility

In both the MetLife report and the Paychex survey, respondents referred to the benefit of time, whether in the form of flexibility in work schedules, additional paid time off, the ability to take more unpaid time off, or changing to a regular four-day work week.

A recent four-day work week study in the United Kingdom showed that 39% of employees said they were less stressed, 62% found it easier to balance work with their social lives, and 55% reported an increase in their work productivity.

Of all the benefit program options discussed in this paper, this is arguably the most difficult for the average employer to adopt. After all, work schedules impact others beyond the individual employee. However, based on research, this particular option could prove to be the most transformational of all.

Takeaways for Remote Working and Employee Benefits

- Nearly a third of American companies (31%) now offer employees the option of working entirely remote. Almost as many – 29% – offer a hybrid option that only requires coming onsite for one to four days a week.

- Employees who work remotely tend to use benefits differently than their onsite colleagues. Offering a competitive package that accommodates that differential helps encourage current employees to stay and prospective employees to come aboard.

- 88% of employees say they were satisfied with their benefits package when working onsite, but that dropped to 71% when they switched to remote working, and dropped again, to 65%, if their company had not updated its benefits package in response to going remote.

- The benefits most frequently cited by employees as must-have benefit priorities and perk preferences focus on different types of healthcare insurance, savings for healthcare expenses, retirement savings and planning, mental and emotional well-being, help with home office expenses, financial wellness, student loan debt, and more flexibility in work schedules.

- Employers can address a majority of must-have benefit priorities and perk preferences by including six specific options in their benefits program: ICHRAs, LSAs, HSAs, healthcare and dependent care FSAs, Student Loan Reimbursement Assistance (SLRA), and more flexibility in time schedules (including the possibility of a four-day work week).

About the Company:

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.

Learn more at dpath.com or call (800) 633-3841.