As new technologies emerge, TPAs who offer both CDH account and COBRA administration should continually evaluate their day-to-day business operations to reduce costs through greater efficiency.

Improvements in technology give rise to numerous opportunities for cost reduction, but they also introduce important questions that must be addressed. For example, is relying on two or more systems for separate but related business functions creating more work for TPAs? Would a single system be more profitable? Do multiple technology platforms help or hinder regulatory compliance? With multiple options available on the market, TPAs must consider their business priorities and determine whether they should stick with their current systems and operations or find a better solution for CDH account and COBRA administration.

Background

For decades, vendors have offered multiple solutions to help professional benefits administrators manage tax-advantaged accounts. Initially, disparate technology solutions existed for each benefit type, including separate systems for FSAs, MERPs, HRAs, HSAs, and COBRA. Over time, a hodgepodge of systems emerged as TPAs used multiple software solutions to administer different account types, creating new complexities in the workplace.

Consider Ted TPA and the Multi-Solution/Integrated Solution

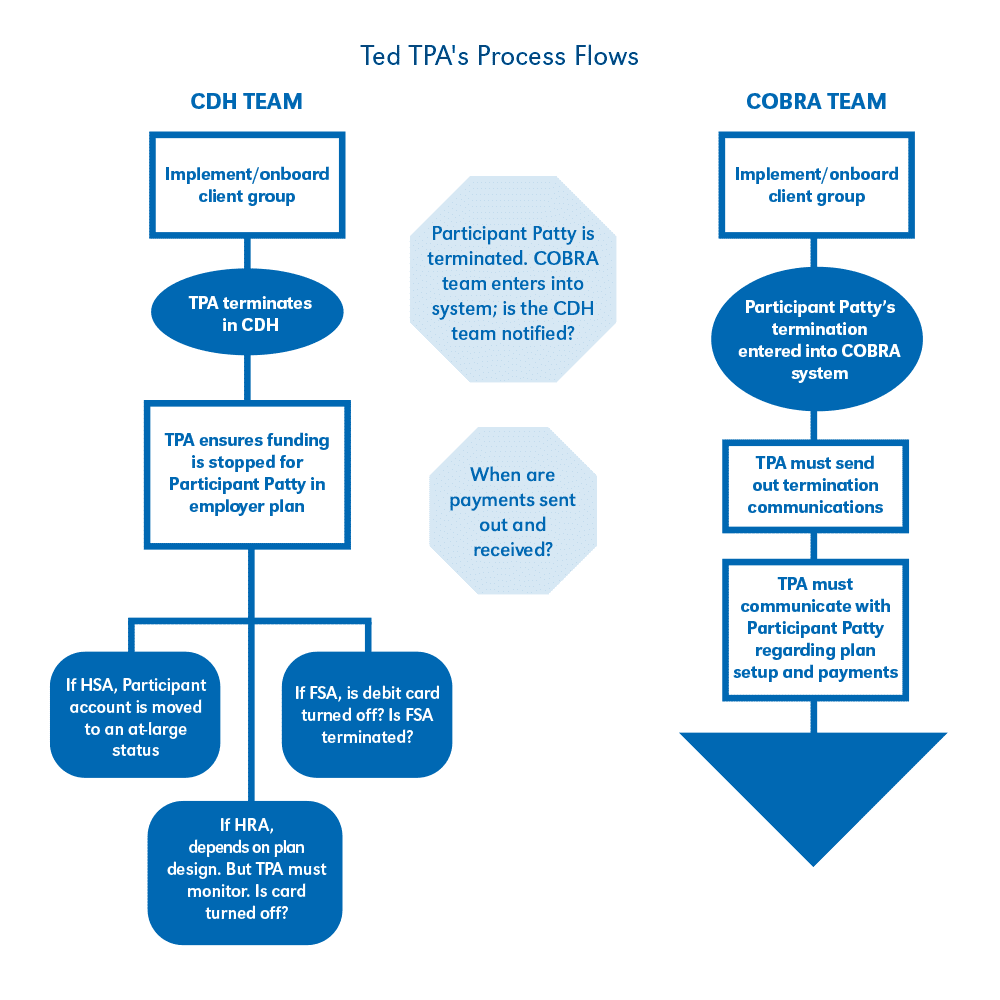

Ted TPA offers FSA, HRA, HSA, and COBRA administration services to his clients. For FSAs, HRAs, and HSAs, he uses one solutions provider. For COBRA he utilizes a different solution. At Ted’s firm, he has a CDH team and a separate COBRA team.

When the offices of Ted TPA onboard a new group, the CDH team enters the group into its benefits accounts platform, with a separate record and account for each participant. At the same time, the COBRA team enters the group into a separate billing platform. One day, Ted TPA’s COBRA team learns that Participant Patty was terminated by her employer. The COBRA team enters the change into their system and ensures that the communications process kicks off. Then, the COBRA team notifies the CDH team, who then enters the termination into their system. In the CDH system, the team must make sure the debit card is shut off, no post-termination claims are adjudicated, and that the employer is no longer charged for that participant. If any of these steps are missed between the two teams and/or systems, serious compliance issues can emerge.

All in all, Ted TPA’s teams are doing twice the work (or more) with the multi-system approach. Plus, if there’s a breakdown in process flow, there are a host of costly issues that can arise.

With a multi-system or integrated solution, TPAs can be left in the lurch with the following issues, which hinder efficiency and can lead to major frustrations:

Dual data entry

Whether a TPA utilizes multiple platforms or chooses a vendor with “integrated” systems, they often have to perform duplicate data entry. They will enter a group on the CDH side, then have to enter the same group again for COBRA.

Lack of automation

Whether a TPA uses multiple vendors or “integrated” systems, automation may not exist or be significantly limited. If an FSA participant is terminated, the TPA first has to update the information in the CDH system and then update the information in the COBRA system. The lack of automation can be especially problematic with a multi-vendor approach. When an FSA participant is terminated and has a remaining balance for the account, the COBRA team relies on the CDH team to provide the balance information. Or if the employer’s COBRA TPA is different than the CDH TPA, how is this information relayed between the two?

Communication breakdowns

Among the chief concerns for any company is optimizing business processes and operations. When operating on two systems or an “integrated” system, it is crucial that communication occurs in a timely and effective manner. If the COBRA team does not relay to the CDH team that a participant has been terminated, it could leave an active participant on an employer’s plan and the employer continuing to pay for that individual. Or even worse, if the participant isn’t properly terminated in the COBRA system, it could create a compliance issue, which can be costly for the employer and the TPA.

Compliance headaches

With COBRA, compliance is of the highest priority and follows very rigid regulations. Failing to send communications on time or accepting late payments can lead to a failure to comply. In turn, this can be very costly for the employer and the employee (who could lose coverage).

Higher costs

Costs are a major consideration for any business. Multi-platform TPAs are likely paying higher rates, due to having multiple vendors instead of a single vendor offering volume pricing. Even with an “integrated” system, that vendor has higher compounded costs associated with more than one support team, multiple development teams, duplicate overhead, etc. Internally, medium to large sized TPAs generally employ both a CDH team and a COBRA team. Paying for additional personnel can be costly in terms of salary, benefits packages, overhead, and more.

Dual customer support

When a problem arises, TPAs need to know that they are being heard and that their issues are being addressed. Using multiple vendors results in a mixed bag of expectations and results, as one side may provide excellent support while the other does not. Even with an “integrated” solution, customer support is not singular since one team knows the CDH software and another knows the COBRA software.

Increased implementation time

Implementation and learning a new system can be stressful and very time consuming. Learning two separate systems or the nuances of an “integrated” system multiplies the stress level, the frustration, and the amount of time it takes for a TPA to get up and running successfully.

Unsynchronized software updates

Using solutions from different software vendors means that the systems are not in sync; one platform may be up-to-date while the other lags behind. For an “integrated” system, the synchronization issues also apply. With separate development teams and expectations, the left hand often does not know what the right hand is doing. The teams may be working on separate schedules with different priorities. How will an update on the CDH side affect the COBRA functionality (and vice versa)?

All in all, Ted TPA’s teams are doing twice the work (or more) with the multi-system approach. Plus, if there’s a breakdown in process flow, there are a host of costly issues that can arise.

Consider the following sample process charts for Ted TPA, in which the CDH and the COBRA team are performing redundant tasks and must rely on seamless communication.

Restructuring the Workload through a True All-in-One Solution

Fortunately, as technology has improved, so have benefits administration solutions. For example, FSA solutions providers also created solutions for other benefit account types such as HRAs, HSAs, and, in some cases, COBRA. In addition, market changes such as business mergers and acquisitions led to fewer players, but more sophisticated software. No longer does a TPA have to partner with multiple entities to offer a full line of services.

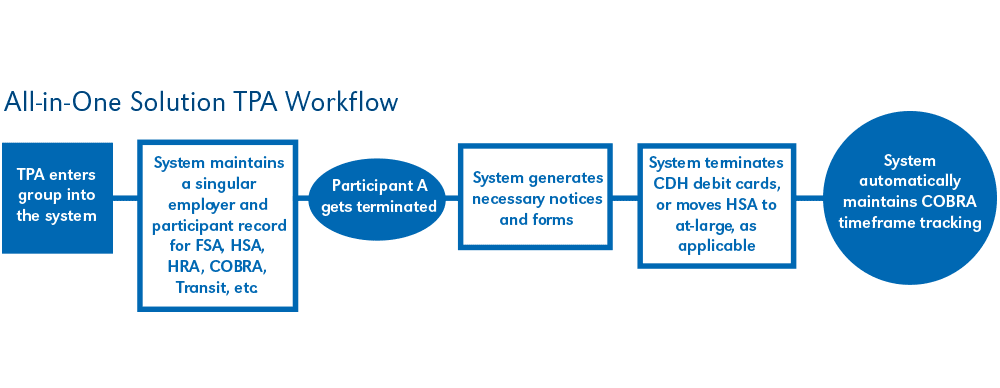

Consider Tabitha TPA, Ted TPA’s competitor

Tabitha has chosen a different approach. Tabitha has chosen an all-in-one solution that offers FSA, HRA, HSA, and COBRA administration in a single platform designed to administer all of these accounts. This all-in-one platform is not a combination of systems integrated together to look like a single system, nor is it a collection of independent systems that exchange information. Rather, Tabitha TPA’s system is a singular platform designed and developed to administer all CDH accounts and COBRA billing from a single, shared data record.

Tabitha only employs one team of account managers who are trained in both CDH account and COBRA administration. When they onboard a new group, they enter the information one time into the all-in-one platform. Both the employer’s account and the group’s participant accounts have CDH and COBRA attributes.

Therefore, when Participant Paul is terminated, the team enters the information into the platform one time, and the system automatically issues the necessary compliance notices and communications. It also triggers other actions (based on Paul’s benefit accounts) to deactivate debit cards, reject claims for post-termination service dates, and more.

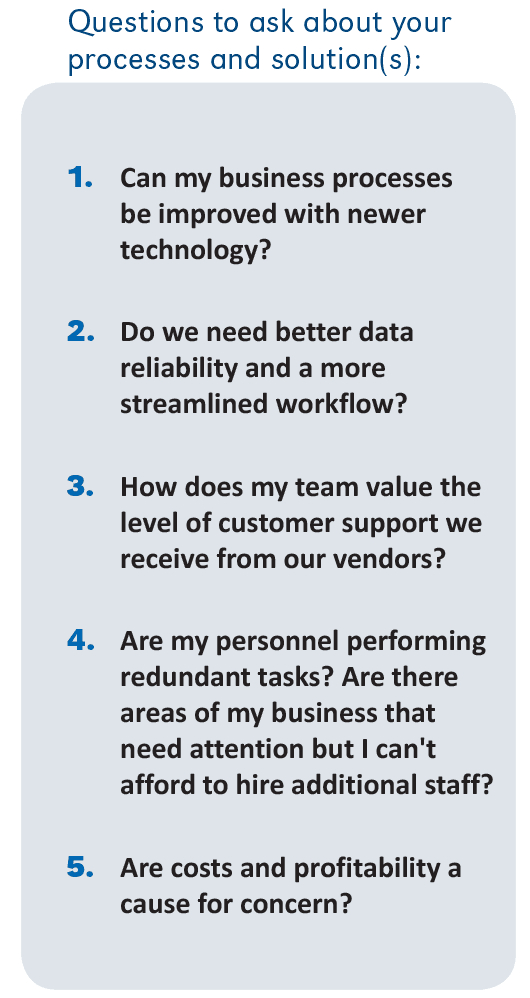

Like Tabitha TPA, benefits administrators should take a long, hard look at their business processes and consider a comprehensive benefits administration solution. Ultimately, a comprehensive solution built by a single vendor from the ground up specifically for CDH account and COBRA billing functionality can provide a superior administration experience to that provided by “integrated” and multi-platform solutions. Among the benefits of the all-in-one solution:

Singular group and participant setup

A platform that includes CDH account and COBRA administration should be able to create one set of records for each group and individual participant, with a single file structure, as opposed to having multiple records for one entity. This greatly reduces the chance for error and simplifies record keeping.

Greater automation

Automation is key to speeding up and enhancing the TPA’s workflow. When a comprehensive platform utilizes a singular record, there is no need to ensure each change is updated in multiple places. A change on the CDH side saves to the same record that also includes COBRA data. In addition, a termination will trigger a chain of events for necessary COBRA actions and any required CDH account actions.

Enhanced customer service and system support

When a TPA needs customer support, there is only one point of contact – the solution provider. In turn, the TPA can hold a single entity accountable, rather than chasing down issue resolutions from different vendors. Software updates apply system-wide and the TPA’s solution is always up to date.

Better data reliability

When an employer or participant record is updated in the all-in-one solution, the data doesn’t have to be updated across multiple platforms. The TPA does not need to worry about synchronizing multiple systems. Updates are delivered comprehensively and in real-time.

Confident compliance

COBRA is rife with compliance regulations. If a participant is terminated, the TPA’s teams must ensure they communicate with one another or else risk triggering a very costly compliance error. Through the comprehensive benefits platform, terminations should automatically set off a chain of events that ensures the proper communications go out to the participant, including notifications, billing, and time frame tracking.

Lower costs

Partnering with a single technology provider should be less costly than using multiple vendors. A single provider eliminates redundant costs for licensing fees, overhead, and related expenses, and typically reduces overall monthly costs. Staffing requirements can also be re-assessed, and teams better streamlined.

Greater team flexibility

The ability to cross train team members is invaluable. No longer does the TPA have to have a “COBRA specialist” versus a “CDH specialist.” Operations training on multiple lines of service is easier and often more effective when involving a single, all-in-one system. This allows the TPA to have better coverage if someone is out and reduces the need to hire additional personnel. The TPA can also repurpose personnel to focus on other important business needs.

Accelerated training times

A single platform is easier to learn than multiple systems. This allows the TPA’s team to receive training across the board on one system, rather than learning the nuances and processes of multiple systems.

Increased marketability

TPAs who can offer their clients simpler, more efficient benefits administration can boost their marketability and greatly increase their revenue opportunities. Using an all-in-one platform not only improves the TPA’s workflow, but it also offers better usability to employers and participants.

Singular experience

On the public-facing end of the TPA’s business, satisfaction among employers and participants can be a concern. With a single solution, there is no need to try to develop an interface that merges two systems together for a singular experience. In the all-in-one solution, employers and participants use a single log-in and access all the necessary information from one location. This can lead to better overall satisfaction from clients and lower operating costs for the TPA.

Conclusion

As the needs of TPAs drive product development, technology providers seek not only to keep up with competitors but also to set themselves apart within the market. Some vendors sell platforms with narrow functionality, offering solutions that are tailored specifically to only FSA and HRA accounts, or only COBRA/billing, or only Health Savings Accounts. Other technology providers have progressed to delivering cloud-based benefits administration solutions that provide the ability to perform CDH account and COBRA administration in their systems.

The solutions with narrow functionality create inherent issues for TPAs who want to offer CDH account and COBRA/billing management services; some providers may have “preferred partnerships,” but the multiple relationship aspect is inherently problematic. Depending on a TPA’s needs and capabilities, it can choose to use multiple vendors, a provider with ”integrated” systems, or a partner that offers true all-in-one functionality.

It is a fact that old habits can be hard to break. Factors that include brand loyalty and/or being comfortable with “the way we’ve always done it” keeps some businesses from moving forward. For TPAs who want to become more efficient and streamline their workflows, finding a single solutions provider with a technology platform that allows singular account setup, CDH and COBRA attributes for a single record, and singular customer support is key for operational flexibility and more streamlined processes.

About the Company: For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.