Today’s healthcare consumers have more choice than ever when it comes to healthcare benefits. However, research suggests they are not utilizing those benefits as effectively as they could, in large part due to lack of knowledge and understanding about them. For third party administrators, understanding where the education gaps exist and providing solutions to address them is key to client satisfaction and business growth.

BACKGROUND

Healthcare benefits are complex, and for many people, hard to fully understand. Endless insurance options, confounding terminology and acronyms, stringent IRS rules, contribution and spending limits, and other factors all contribute to an often perplexing subject.

Numerous studies have found that serious healthcare education gaps exist in the United States.

- 80% of workers said they understand their benefits, but when tested, only 49% actually did (Guardian Insurance Company).

- Employees generally chose health insurance plans that weren’t cost-effective when considered against their actual medical spending (NBER).

- 35% of younger consumers have little understanding of the comparative advantages and disadvantages of their health insurance options (C Space Health).

- Nearly one in five employees (19%) are not confident they understand everything they signed up for during their last open enrollment (AFLAC).

- A majority (62%) of employees say that their employer does not act as a resource for healthcare-related questions (Maestro Health)

To help TPAs develop strategies to address these education gaps, DataPath conducted a survey in August 2019 to assess the causes and determine potential solutions. The underlying motivation was to gain clarity around how much healthcare consumers really know about how to access and use their healthcare benefits, and what is keeping them from becoming more informed.

To gain a better understanding of how healthcare and benefits education impacts consumer decisions, we surveyed hundreds of people from different companies, all of whom either had a Flexible Spending Account (FSA) or Health Savings Account (HSA).*

*Online survey included 400 responses from FSA and/or HSA account holders.

SURVEY RESULTS

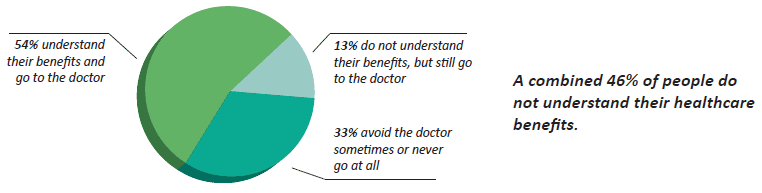

Lack of Knowledge Prevents Doctor Visits for Many

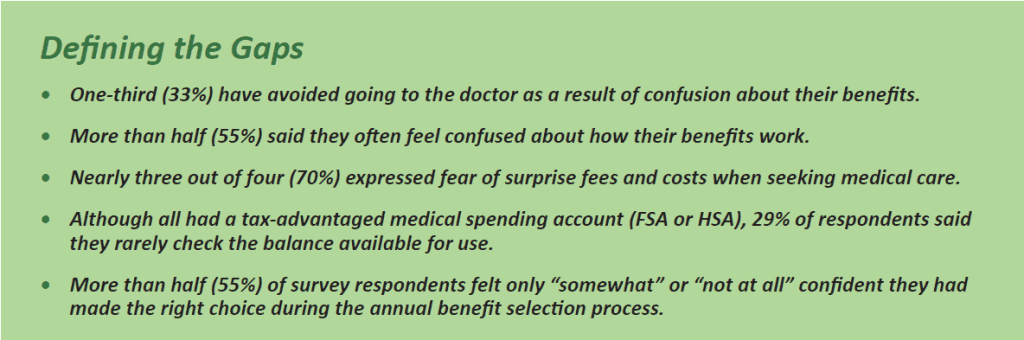

When asked “Do you ever avoid going to the doctor or using your benefits because you aren’t completely sure how your benefits plan works or what’s included?,” nearly 1 in 3 people (32.7%) responded that they either avoid the doctor sometimes or never go at all.

Healthcare is readily available in most areas, yet a significant percentage of people do not visit their physician due to a lack of understanding about how their benefits work. Avoiding doctor visits thwarts the early diagnosis and treatment of health problems that are crucial for achieving the best patient outcomes. By regularly visiting the doctor, patients will be more aware of when serious health problems arise and can take appropriate action to prevent overall health from getting worse.

Preventive medicine not only results in better long-term health, it can significantly reduce healthcare costs for patients and providers. Regular doctor visits are especially important to pregnant women and people with chronic diseases such as heart disease or diabetes. In these situations, avoiding or even delaying doctor visits can put lives at risk and greatly escalate costs.

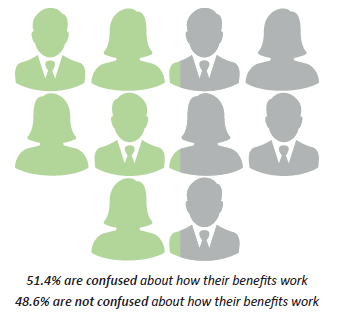

More Than Half Experience Confusion About Their Benefits

One of the most important elements of a successful healthcare plan is that plan participants understand the benefits available to them. They also need to know how to access those benefits and use them effectively.

In our survey, we asked “Are you ever confused by how your benefits work?” More than half of the respondents (51.4%) reported they sometimes felt confused about how their benefits work.

The high percentage of consumers that report confusion around how their healthcare benefits work points to a major systemic problem in the healthcare benefits delivery system – a lack of education. For the most part, today’s service providers do an excellent job of managing the administrative aspects of healthcare benefits. Where they tend to fall short is on the educational component. If employers and benefits administrators focus more on helping consumers understand how healthcare benefits work, it could significantly reduce the percentage of employees who feel confused, or even overwhelmed, by the healthcare benefits system.

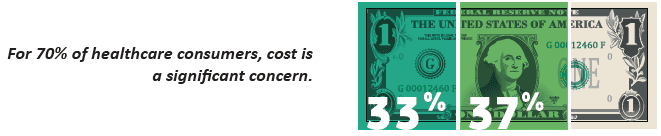

Widespread Fear of Doctor Fees Reduces Visits

For many healthcare consumers, cost is a primary issue. With so many different pieces, such as deductibles, co-pays, and out-of-pocket expenses, cost is also an area where knowledge and understanding are often lacking.

When asked “Are you ever afraid of surprise fees when visiting a doctor’s office?,” 37% of respondents said they are afraid of surprise fees, and 33% are somewhat afraid.

When consumers don’t understand the costs involved in a doctor visit, they are less likely to get the care they need, which can have both short- and long-term impacts on their health.

For years, information about healthcare costs ranging from basic primary care to surgical procedures, hospital stays, and more, has been hard to come by. Fortunately, with the growing trend for more transparency throughout the industry, this is beginning to change. More service providers are supportive of increased consumer transparency. Insurance providers are starting to make it easier for patients to determine costs by providing cost estimator tools on their websites. Health systems are publishing information on their websites that enable consumers to make cost and quality-of-service comparisons before choosing a provider.

Underuse of HSAs and FSAs

Tax-advantaged healthcare benefits, such as Flexible Spending Accounts and Health Savings Accounts, can be a major tool for keeping costs down. The pre-tax contribution benefits, which reduce a person’s taxable income, and the ability to use the set aside funds for approved healthcare expenses are a significant part of consumer directed healthcare.

In the survey, participants were asked, “How often do you log online to view your FSA/HSA account balances?” Nearly one in three (29%) of respondents rarely check their FSA/HSA account balances, and only one in five (18%) check them often.

When actively using their FSA or HSA, healthcare consumers can save significant amounts of money annually and for the long term. Both accounts are very useful tools for tax savings and setting aside money for healthcare costs. Infrequent oversight, however, can lead to mistakes that cost thousands of dollars in the present and in the future.

If the FSA/HSA is not used, people lose out on tax savings and tax-free earnings; the use-it-or-lose-it policy (FSA) and not contributing and investing tax-free (HSA) can result in thousands of lost dollars per year. In the long run, it can cost more to have the account and not use it than to have no account at all.

Healthcare Consumer Confidence is Sagging

Finally, consumer confidence around their healthcare choices needs help. When plan participants feel confident they chose the right plan for their needs, they tend to be more engaged in using their benefit options.

The survey asked, “When you choose a benefits plan/options, how confident are you that you made the right decision?” More than half (55%) of our survey participants reported feeling only “somewhat” confident they made the right choice in terms of their benefit plan and options, while almost 5 percent said they were not confident at all.

Keep in mind that healthcare benefits are designed to help employees select the healthcare services that meet their needs while managing the costs of those services. That’s why more employers are offering a variety of plan options to meet the diverse needs of their workforces. But no matter how robust their employer’s plan offerings, employees won’t embrace them when they don’t understand them. In the healthcare benefits world, it takes clear and understandable information for participants to make smart decisions regarding their plans and options.

SOLUTIONS

How does a third party benefits administrator address the glaring issues within the healthcare industry?

Based on our survey results, as well as our experience working directly with plan sponsors, TPAs, and plan participants, we believe there are several key elements that would help move the healthcare benefits engagement and usage needles in the right direction.

- Promoting consumer directed healthcare

- Delivering a robust and wide ranging approach to benefits education among generations

- Providing educational materials that are easy to understand

- Using employee engagement programs to encourage participation in the plan

- Adopting systems that enable employees to understand their options and know how they work when making important healthcare decisions

IDENTIFYING OPPORTUNITIES

As an advocate for consumer directed healthcare, including Flexible Spending Accounts, Health Savings Accounts, Health Reimbursement Arrangements, and other employer-sponsored healthcare benefits, TPAs are the first step toward reducing healthcare costs and delivering higher consumer satisfaction.

However, consumer directed healthcare merely begins there. Working with insurance providers to get better group rates and integrated claims processing is another avenue.

In addition, promoting healthcare education can also help not only with greater FSA/HSA adoption, but also ensure those tax-advantaged dollars are being maximized. Employees need the confidence to be their own advocates. That’s where a comprehensive benefits education and engagement strategy come into play.

BENEFITS EDUCATION AND ENGAGEMENT STRATEGIES

Both employers and employees look to the TPA as a leading expert on healthcare benefit accounts. As such, the TPA needs to be prepared to deliver greater insight. Preparing yourself with a solid plan to educate employees and engage them with their benefits goes a long way.

First, your benefits account strategy should include printed materials, email communications, videos, and a social media strategy so that you reach as many participants as possible. This should be adopted year round, not just during enrollment season. Once enrollment is complete, employees need to know how to use their benefits. You can always tailor your approach to different employer groups, if necessary.

Remember that today’s labor force has four distinct generations, with Baby Boomers, Generation X, Millennials, and Generation Z. Each of these groups has different views on media and education. Where Boomers and Gen X are comfortable with face-to-face interactions and written materials, Millennials and Gen Z are more tech-oriented, preferring digital communication.

Second, incorporating an employee benefits education and engagement program can pay big dividends. Remember that healthcare is hard to understand for many people. A program that delivers digestible nuggets of key information in fun, lighthearted materials can help. Blogs, videos, comics or other illustrated stories, and social media are great for delivering the “how to” information that is often not absorbed during enrollment.

Another piece of the education strategy is to make sure your clients know how to reach you. Listing your phone, email, and social media accounts allows employees to reach you through their preferred method of communication. Once your participants feel more assured, account adoption and usage is likely to increase. In turn, both employer and employee satisfaction will rise. Not only will employees make better use of their healthcare dollars, but they should also be healthier in the long run.

QUESTIONS TO ASK

- Do I have the resources available for my account holders?

- How can I further promote plan and benefit adoption?

- Does my solutions provider have materials that I can use?

- Where can I get quality information on the internet?

- Am I maximizing my social media reach?

About the Company: For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.