With four distinct generations in the workplace, employers and benefits administrators find it challenging to build a benefits plan and education strategy that meets the needs of all age groups.

Based on their personal experiences, each generation has its own expectations and preferred style of communication. To reach these groups, employers and communicators should develop a multi-faceted approach that will deliver the best results and happier employees.

Generational Differences: The Great Divide

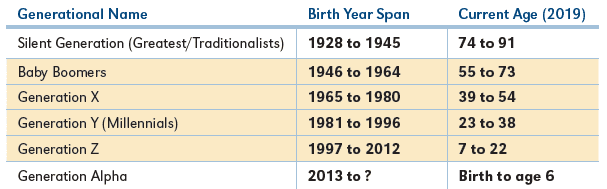

In today’s work place, generational diversity is abundant. The age gap between the oldest and youngest employees is often 30-40 years, with a 50-plus year difference in some instances. There are four distinct generations (periods that span 15 to 18 years) that currently make up the bulk of today’s labor force:

Baby Boomers, those born directly after World War II, make up the oldest workers, while members of Generation Z, which starts just before the turn of the 21st century, are beginning their careers.

Rapid changes in technology throughout the 20th and early 21st century, cultural forces, and personal experiences, uniquely shaped each generation. Given these factors, there are notable differences in how each group views employment, benefits, communications, and more. Despite these differences, however, they do have some overlapping concerns.

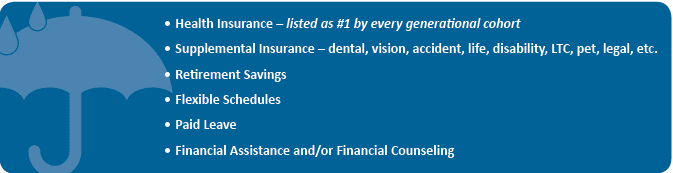

According to The Benefits Guide, the top six desired benefits across all generations include:

Outside of healthcare, each group has different priorities for different benefits. With a large variation in expectations, employers and third party benefits administrators may be struggling to find a benefits plan and effective communication strategy. The following profiles examine each generation’s defining characteristics, their benefits concerns, and the best way to communicate with them.

Baby Boomers

Baby Boomers, born between 1946-1965, make up one-quarter of the current workforce. While a good deal of Boomers have already retired, many are facing higher retirement ages. They are the most traditional of the four generations.

Defining Characteristics of Baby Boomers

Career Driven

In the late stages of their careers, Boomers tend to define themselves by their professional accomplishments. They are hardworking, and often motivated by position, perks, and prestige.

Interpersonal Communication

Born in the mid-20th century, Boomers grew up with television, but the dawn of the internet age occurred after they became adults, had children, and entered the workforce. They value and feel most comfortable with interpersonal communications as opposed to digital media.

Mixed Reactions to Technology

Given their late introduction to the internet and social media (as compared to other generations), they are not universally comfortable with those types of communications.

What types of benefits do Boomers need?

Considering their collective age, it should come as no surprise that healthcare benefits are top of mind. While over half (52%) of Boomers want multiple health plans to choose from, they desire the “traditional” benefits such as major medical, dental, vision, and life insurance. In addition, retirement savings is another top priority.

Many people in this generation are also caring for elderly parents. For working Boomers, the cost of caring for their parents and having flexible hours are concerns.

One surprising statistic of the Boomer generation is their student loan debt. According to Experian, Boomers carry the second-highest average of student loan debt at $34,703. Though most are well past college age and are further along in their career path, this high balance can be partially attributed to parents taking on the cost of their children’s education.

Communication/Engagement

Baby Boomers are not as tech savvy as younger generations. Therefore, the most effective way to reach the Baby Boomers is through traditional methods.

Information can be delivered in person, such as in benefits meetings or fairs, giving this generation the opportunity to ask questions and get feedback. Printed materials, and visuals with supporting text allow Boomers to read and digest what is presented. Conversations by phone are also preferred over email

or web delivery.

Generation X

At one-third (33%) of the total workforce, Generation X is the second largest employment group. Born in the mid-1960s through 1980, Gen X straddles the more traditional preferences of the Boomers and the more modern, tech-oriented Generation Y.

Defining Characteristics of Generation X

Tech Comfortable

They grew up with television and video games, but many were in college or in the early stages of their careers when the internet became a staple in American homes and offices.

Open to Employment Mobility

Gen Xers differ from Boomers in that they are less committed to a single employer and are willing to change jobs to advance their careers. They like roles where they’re given the opportunity to learn, and are more likely to stay with a career that offers growth.

Work-Life Balance

Work-life balance is a top priority. Many Gen Xers are sandwiched between caring for older parents and having children still in their homes. Given their family commitments, they desire flexibility.

What types of benefits does Generation X need?

Like their parents, Gen X places healthcare benefits as a high priority. Many prefer the “traditional” benefits such as major medical, dental, vision, and life insurance, with multiple health plans to choose from. With dynamic family demands, they want more from their benefits than Boomers do.

Generation X is the first generation to wholeheartedly embrace higher education immediately following high school. While Gen Xers are mid-career and should presumably be close to paying off their loans, their student loan debt is higher than the younger Millennials. The average Gen X student loan balance (self and/or kids) is $39,584.

The high debt is due to several factors. Gen X is still paying off their student loans. In the 1980s, even as tuition costs began to rise, government funding began to decline. Second, many of them have sent their children off to college and are assuming the financial burden for it (like their parents have).

Communication/Engagement

Communication with Generation X should be focused on the benefits to the individual (i.e., “how will this help ME?”). Since this generation is comfortable with both traditional printed materials and modern digital media, material can be presented in person, through email, online, or videos.

Generation X likes to analyze and assess, and is drawn to case studies, situations, and games. Given their flexibility, Generation X is arguably the easiest group to communicate with.

Gen Y (Millennials)

Just ahead of Generation X at 35%, Millennials make up the largest age demographic in the labor force. In 2016, not only did they surpass Gen X in the workplace, but they also became the largest age group in the United States, bypassing the Boomers (73 million vs. 72 million).

Defining Characteristics of the Millennial Generation

Tech Savvy

Born between 1981 and 1996, the Millennial generation is completely plugged into technology. The oldest of this generation first experienced the internet during their pre-teen years, and many had access to computers as early as elementary school. They are the first generation to feel at home on the internet.

Keep on Learning

For the Gen Y group, continuous learning is a way of life. One factor that distinguishes Millennials from their predecessors is that they dislike “too many details.” Growing up in the internet age, they had access to a vast amount of information. However, that information was often disorganized and overwhelming. Thanks to Gen X and the older Gen Yers, communication strategies have changed. From blogs to books to news articles and scholarly publications (both in print and on the web), writing styles now feature smaller, more digestible bites with less “fluff.”

Workplace and Career Mobility

Millennials, unlike those before them, are much more career mobile. They expect to change jobs, looking more for lifetime employability rather than lifetime employment. They also hold their employers to higher standards, require frequent feedback, value mentorship programs, and often seek purpose as much as (if not more than) a paycheck.

What types of benefits does Generation Y need?

Though decidedly different than Boomers and Gen X, Millennials place access to health insurance as their top employee benefit – but require more than just insurance. Retirement and workplace flexibility also top their lists. According to Payscale, 34% of Millennials have quit a job because work flexibility wasn’t an option.

Many Millennials are footing all or some portion of the bill for their college education. The average Millennial student loan balance is $34,504.

Communication/Engagement

The most effective strategy for reaching this group is through digital communications. In fact, 85% of Millennials access the internet from their phones. Gen Y often avoids in-person communications such as phone calls and face-to-face meetings. Short, to-the-point communication pieces with interesting visuals are key, delivered by email, social media, websites, and text message.

Generation Z

Generation Z, born from 1997 through 2012, is just beginning to enter the workforce. At 5 percent, they currently make up the smallest employment group.

Defining Characteristics of Generation Z

Technology Wizards

Generation Z is the most technology savvy group to date. They have not known life without television, the internet or mobile devices. On average, Gen Z uses five screens daily – smartphone, tablet, laptop, desktop, and television – and more than half spend at least 10 hours a day on an electronic device.

Cautious and Pragmatic

Despite their youth, Gen Z witnessed two major socio-economic disruptions in the United States: the Great Recession and the Occupy Wall Street movement. As such, they are defined by cautiousness, practicality, and pragmatism, and they are very mindful of the future.

Go-Getters

Members of Generation Z are ambitious and competitive. Nearly two-thirds (64%) say career growth opportunities are top priority when looking for a job, and two in five want to own their own business someday.

The independent-minded Gen Z desires workplace autonomy, and they are focused on self-improvement. In the workplace, they want to be judged on their merit. Like Millennials, flexibility is a top priority.

What types of benefits does Generation Z need?

Generation Z’s youth contributes to their benefits concerns. Most have not started families and many are still on their parents’ healthcare plan. However, nearly half of Gen Z worries about financial wellness such as student loan debt.

Not surprisingly, Gen Z has the lowest average student loan balance of all groups at $12,523. As more students enter college and then continue on to the workforce, however, this figure will go up.

Communication/Engagement

Even moreso than Millennials, Generation Z is heavily reliant on technology. They digest information in short, brief narratives shared through social media, email, online, and texting. Generation Z will also look to co-workers and family members for their expertise and information.

Conclusion

With four generations in the workforce, there is no “one-size-fits-all” approach to benefits, education, and engagement.

Not surprisingly, each generation lists healthcare and retirement as their top priority. Healthcare costs can be unwieldy, particularly for those who are older or not in good health. In addition, people want the security of knowing that they’ll be able to retire, which is why additional benefits such FSAs and HSAs, and dependent care expense plans are also popular.

For those who have college debt, some form of loan repayment assistance and/or financial counseling can be very appealing with the average new college graduate holding roughly $35,000 in student loan debt. Consider this: according to a 2016 survey from Student Loan Hero, 46% of employees would rather have student loan repayment assistance over a 401k match, assuming equal dollar value; for younger employees (aged 18-24), that number climbs to 54%. Almost 53% of employees indicate they would choose student loan repayment assistance over additional vacation or paid time off.

Benefits Expectations by Generation

The challenge for employers and benefits administrators lies in offering flexibility — not just in employee schedules and job requirements, but also in benefits offerings and in the methods of engagement and communication used to convey them.

A broad approach to communication and engagement is critical. In-person benefits meetings and benefits fairs provide older generations the chance to read, interpret, and ask immediate questions for feedback. Plus, pairing the face-to-face communications with a follow-up strategy of sending information through email, social media, and/or posting online will reach the younger generations. This even-handed approach also allows the people to access information from home or at their desk when a person may not be available for questions and answers.

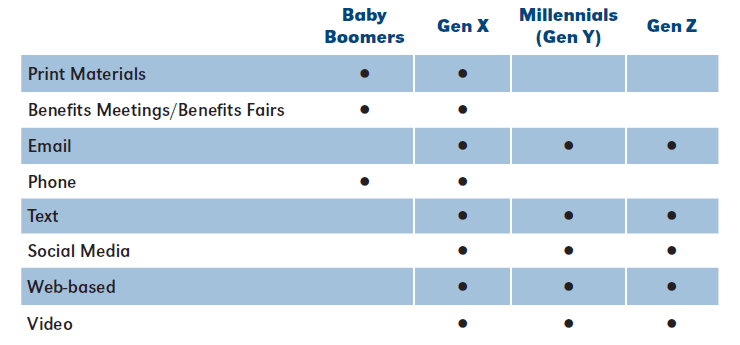

Ideal Communications Strategies for a Multi-Generational Workforce

About the Company:

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.