Help Participants Use Benefits with These 5 Tools

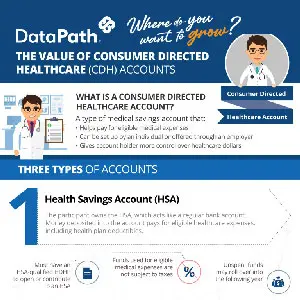

During open enrollment, many participants are enrolling in plans for the first time. “Firsts” are often overwhelming, and once the benefit year begins, participants may need help knowing how or where to begin. As employees expect more and employers become increasingly cost-conscious, it’s harder to provide a mutually satisfactory benefits package. To make utilization as easy as possible, TPAs and employers can offer resources to help participants understand, access, and utilize their benefits. Five of