This year marks the 20th anniversary of Health Savings Accounts (HSAs), which became available in 2004 as part of the Medicare Prescription Drug, Improvement, and Modernization Act. The legislation also enacted Internal Revenue Code section 223, which outlines the specific medical expenses eligible for purchase with these tax-advantaged funds. The HSA market is thriving thanks in part to their rise in favor as alternative retirement savings accounts. With such an increased focus, now is the time for TPAs not already in the HSA market to capture their share of its lucrative revenue stream.

History of the HSA Market

The HSA is a relative newcomer in consumer directed healthcare.

Other employer-sponsored, tax-advantaged benefit accounts came first, including Flexible Spending Accounts (FSAs) in 1978 and Health Reimbursement Arrangements (HRAs) in 2002.

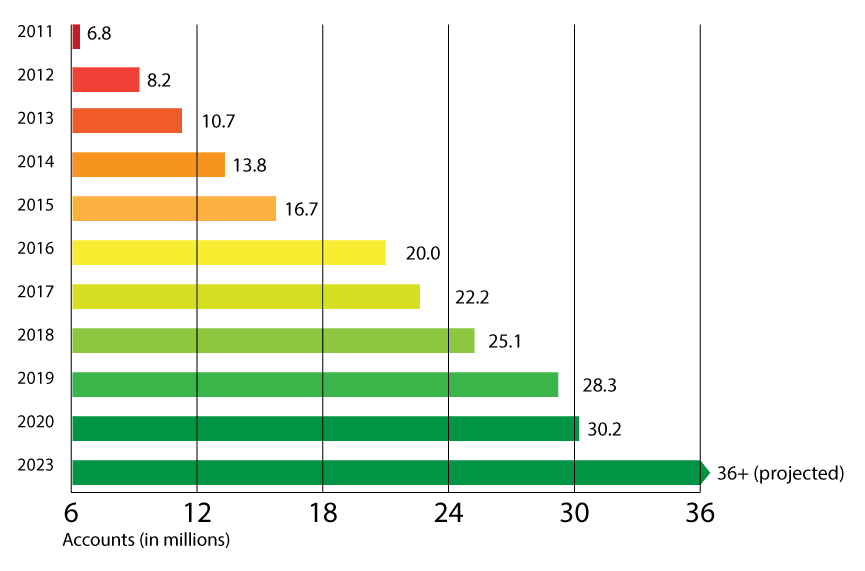

By their 10th anniversary in 2014, enrollment in HSAs had reached nearly 14 million.

Over the next decade, enrollment continued growing by more than 150 percent, reaching 36 million accounts by the end of 2023.

HSA growth is expected to continue at a high rate for the foreseeable future, with Datos Insights predicting there will be nearly 43 million accounts by the end of 2025. Younger consumers have embraced HSAs, with 1 in 5 Americans in their 30s now owning one.

But thanks to changing market demands and increased government focus, HSA/HDHP enrollment could exceed even these industry expectations. They simply cannot be ignored by growth-oriented, success-minded TPAs.

Current Legislative Climate for the HSA Market

As of early February 2024, an unprecedented 40 bills regarding Health Savings Accounts had been introduced in the current (118th) session of Congress – 30 in the House and 10 in the Senate.

A sampling of House bills which could have a major impact on the HSA market (all of which have been referred for consideration by the House Ways and Means Committee as of this writing), include:

Examples of current Senate bills that could have a major HSA market impact (all of which are referred for consideration by the Senate Finance Committee as of this writing), include:

The ultimate enactment of any of these highlighted bills could lead to a dramatic surge in HSA adoption beginning all but immediately.

HSA Market Forces

Even though Flexible Spending Accounts (FSAs) are the oldest type of tax-advantaged CDH account, and still the most popular among employers, the winds have begun to change. For example, although 63 percent of U.S. companies offer FSAs, more than half (57%) now offer HSAs, according to the SHRM 2022 Employee Benefits Report.

Part of the reason employers are favoring HSAs more and more over FSAs is liability. With a healthcare FSA, the employer is on the hook if a participant uses all of their funds before the end of the plan year, then leaves the company before completing their contributions. (Bills are periodically introduced in Congress to remove the annual contribution limits for FSAs, but this would present astronomical potential liability for sponsoring employers.)

By comparison, HSA account owners can only spend up to their current available balance, regardless of the amount they intend to contribute for the plan year. That factor alone increases the popularity of these accounts with sponsoring employers.

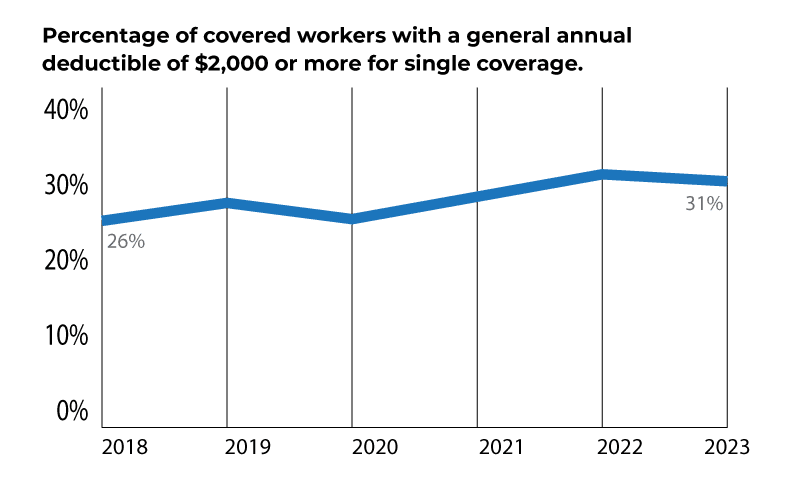

Economic concerns have an impact on the HSA market in other ways as employers help balance budgets by passing off a greater share of healthcare expenses to employees. For example, according to findings by the Kaiser Family Foundation, the percentage of workers with an annual health insurance deductible of $2,000 or more for single coverage grew from 26 percent to 31 percent between 2018 and 2023.

Plans with an individual deductible of $1,600 or more ($3,200 for family coverage) are HSA-eligible.

Another HSA market factor is the Millennial generation, of whom an estimated 20 percent already own an HSA account. Studies reflect that Millennials are more satisfied with their health plan choices – including HDHPs – than their older counterparts. This group is also healthier and less likely to use medical services. Finally, Millennials are also more likely to do cost comparisons before making healthcare decisions for medications and procedures. As the largest demographic in the current labor force, Millennials hold significant influence on the benefit decisions made by employers.

Lastly, there’s the issue of overlapping account utility. FSAs and HSAs cover essentially the same IRS-defined eligible expenses. If the annual contribution limit for HSAs is raised or removed and the HDHP requirement is eliminated, nearly every American would gain access to an HSA with significant contribution limits, rendering healthcare FSAs unnecessary.

How Does This Affect TPAs?

For TPAs that do not provide HSA administration services, a continued shift towards HSAs in the marketplace could significantly impact their long-term business model. Over several decades, the administration of FSAs has been the core business for many administrators. When HSAs emerged, numerous TPAs opted out of offering HSA services due to a reluctance to take on additional responsibilities in an unproven market. However, nearly two decades later, TPAs that remain on the periphery of the flourishing HSA market may be jeopardizing their future viability.

Many TPAs highlight the perceived challenges of competing for HSA business against traditional banks and financial institutions that provide the accounts with minimal or no administration fees. These competitors often offer little more than basic savings accounts, unaccompanied by any degree of professional HSA administration. Consequently, account owners with bank HSAs often find themselves managing their accounts independently, lacking the professional guidance and assistance offered by experienced administrators.

Another challenge confronting TPAs is the unpredictable nature of disruptive technologies. Startup companies identifying market opportunities not currently being addressed by banks or TPAs may seize a significant market share, especially in response to regulatory changes. If and when such a market disruption occurs, TPAs are likely to be the most impacted, as banks, with their deeper pockets and diversified revenue strategies, may be able to weather the storm more effectively. Nevertheless, strategic preparation can mitigate the threat posed by this type of competition.

Employers seek options to attract and retain talent, and many are willing to cover administration costs if it results in not only reducing healthcare cost burdens but also enhancing satisfaction among their workforce. To establish a robust position in this competitive field, TPAs must offer HSA solutions to employers that leverage their strengths, enabling them to deliver excellent service while minimizing administrative workload and costs.

TPAs that do not offer HSA administration need to again contemplate adding it to their suite of services. The reality is that, like many businesses, TPAs are often forced to focus on addressing immediate concerns. What about positioning themselves for the future?

The Right Position – Leveraging Your Strengths in the HSA Market

TPAs have numerous advantages that distinguish them from banks and market disruptors. Although required to charge for their services and unable to accommodate unknown entities, TPAs can fortify their standing in the HSA market by leveraging an array of inherent strengths that surpass or strategically counter their competitors.

Experience

Most importantly, TPAs possess unparalleled expertise in the intricacies of benefits administration. Being financial institutions, banks provide HSAs as a secondary service, while market disruptors concentrate on exploiting specific market aspects, often lacking a comprehensive understanding of the broader context. By leveraging their proficiency in benefits administration and its distinctive compliance challenges, TPAs have the capacity to deliver comprehensive professional services, thereby serving as a significant differentiator from their competitors.

Simple Account Administration

Partnering with a platform provider that facilitates seamless account administration is essential. TPAs, burdened with numerous responsibilities, know that dedicating an excessive amount of time to account administration detracts from other critical tasks. An administrative platform with streamlined account setup, efficient administration, automated claim substantiation capabilities, and comparable features allows TPAs to capture market share by providing valuable services without significantly increasing their workload.

Flexibility

In addition to easy account administration, TPAs require the ability to present diverse plan designs catering to the varied needs of their clients. This is a domain where expertise surpasses more economical options and superficial innovations. Partnering with an adept platform provider that wields control over both the software and banking relationships can help TPAs deliver greater flexibility compared to collaborations with disparate entities.

Plan Features and Benefits

The workplace is a competitive field for employers. To attract and keep high-caliber talent, companies need robust benefits packages. An HSA provider equipped with comprehensive features such as a secure web portal, user-friendly mobile app, account-linked debit cards, online receipt vault, powerful investment tools, and more, can elevate an employer’s appeal to potential hires.

Low Investment Threshold

One of an HSA’s key advantages is allowing account holders to invest and grow their funds tax free. A low investment threshold facilitates stronger, quicker account growth, and delivers higher client satisfaction. Some banks offer a $0 minimum for investment, but what actual value is there for account holders in being able to invest $20? The returns are minimal. However, platform providers with minimum thresholds such as $500 or $1,000 present an enticing option, foregoing the gimmicks and allowing account holders to experience tangible growth when opting to invest.

Investment Tools and Experience

In addition to an effective investment threshold, account holders should enjoy easy access to plenty of information, including investment prospectus, investor statements, and lifestyle models developed by Registered Investment Advisors (RIAs). In addition, a platform provider delivering investment services should engage a certified investment adviser to address any concerns regarding expertise and reliability.

Customer Support

TPA reputations hinge significantly on customer service. An all-encompassing platform provider, handling payment processing, investment services, and more, offers a unified point of contact in the event of any issues. This ensures faster problem resolution compared to situations involving multiple entities. Ultimately, this plays a pivotal role in achieving a superior customer experience.

Reporting and Tax Forms

Advanced administration platforms provide comprehensive reporting capabilities, including the option to schedule data delivery. In addition, account holders must be able to easily obtain tax forms; a platform that allows them to download these forms through a secure online portal or convenient mobile app greatly benefits both the account owner and the TPA.

Marketing

A comprehensive HSA platform provider can help TPAs build their business profile with clients by furnishing marketing materials and services. These offerings may encompass brochures, fact sheets, blogs, employee engagement programs, and additional resources.

Outsourcing

Last but certainly not least, TPAs and brokers have the option of offering HSA services by outsourcing to a qualified and experienced HSA administration-as-a-service partner. The outsourcing partner can perform all back-office tasks, from enrollment to processing contributions and distribution requests to reporting, ensuring efficiency and regulatory compliance. Better providers also provide customer support services. For those who want to get into the HSA market as soon as possible but aren’t prepared to invest in training and permanent overhead, outsourcing to the right partner can be a very viable option.

Conclusion

HSAs are taking center stage in the CDH market. TPAs who do not offer HSA administration need to evaluate their firm’s current and future needs and capabilities. As competition starts to increase, they will want to position themselves to make the most of their strengths – experience, knowledge, and service – by partnering with an all-in-one solutions provider or qualified administration-as-a-service provider. This type of partnership can enable TPAs to minimize the amount of work taken on by administering HSA accounts while also grabbing a larger share of the thriving HSA market.

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.