During enrollment season, benefits administrators and employers look to build and deliver a benefits package that helps companies keep and attract top talent.

While employees generally report they are happy with their employer’s benefits, statistics show that account adoption is often lacking. With a better understanding of their employer groups and proven educational approaches, TPAs can experience a more successful and fulfilling open enrollment period.

Background

Open enrollment can be a stressful time for benefits administrators, employers, and employees. Brokers and third-party administrators (TPAs) want the best options for their employer clients while also encouraging employee enrollment. Employers must decide what type of benefits to offer, with packages often featuring some combination of health, dental, and vision insurance, life insurance, retirement plans, and healthcare benefit accounts such as Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), or Health Savings Accounts (HSAs). Meanwhile, employees can feel uncertain about what each option means, which coverages are right for their families, and how much they need to set aside for expenses not covered by insurance.

Once the benefits package is built, the next challenge for TPAs and employers is employee adoption. For various reasons, employees may not automatically enroll in health plans or consumer directed healthcare accounts, no matter how generous.

With enrollment season quickly approaching, TPAs can deliver better results to their clients by understanding both employer and employee perspectives while also taking action to overcome obstacles to benefits enrollment.

Employer View – Why Offer Better Benefits

For employers, a solid benefits package provides several positive outcomes: improved recruiting and retention, a happier, healthier workforce, and increased cost savings.

Retaining employees and attracting new talent are the top two reasons cited by employers for enhancing their benefits offerings. A good benefits package can be key in reducing employee turnover, as a recent survey showed that companies that rated highly on compensation and benefits saw 56% lower attrition than those with lesser ratings. Not surprisingly, between 2014 and 2018, the ratio of employers offering consumer directed healthcare plans increased from 30% to 40%.

An additional byproduct of a solid benefits package is higher productivity. Reducing the occurrence of “presenteeism” – when employees show up for work, but don’t perform well because of fatigue, illness, or injury – can be a huge boon for companies. Presenteeism costs employers an estimated $1.5 trillion globally per year. When employees feel appreciated and have the financial and insurance means to take care of their health, employers typically experience an uptick in productivity as well as lower healthcare costs over time.

In a number of instances, employers can save more money even while offering more benefits options. For example, those who offer high deductible health plans generally pay less in total premiums (as do employees) than with other plans. Employers can reduce their FICA and Medicare matching burden by offering healthcare spending accounts like an FSA or HSA, for which employee contributions are pre-tax.

Employee View – When My Company’s Benefits Fulfill My Needs

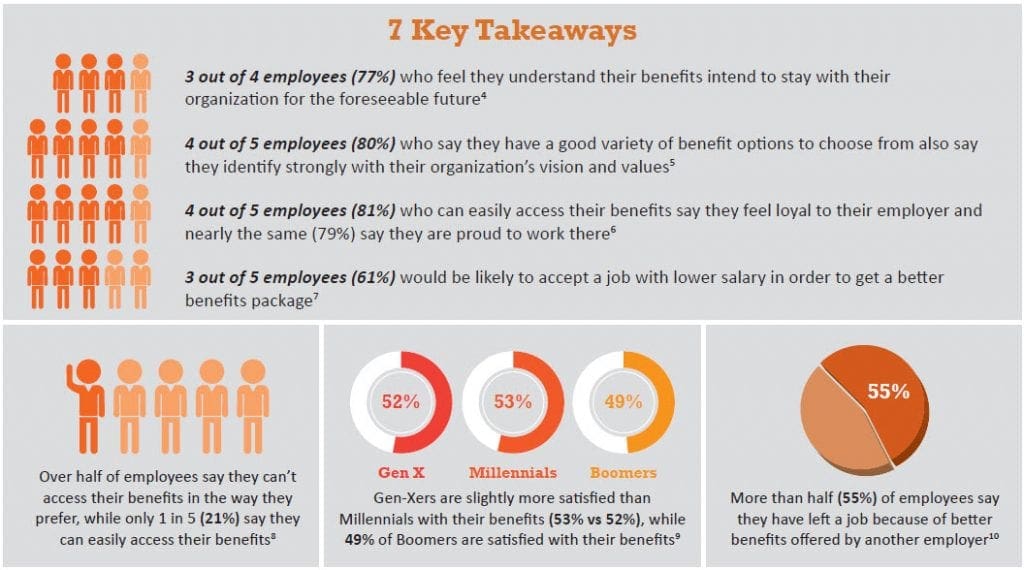

Couple this knowledge of employer views and actions with that of employee views and reactions. Worker loyalty and

retention can often be dependent on what types of benefits the company offers.

Employees are generally satisfied with their benefits. The problem lies in getting them to understand their benefits better so that they are more likely to adopt and use them, which in turn creates more loyalty and higher satisfaction. Open enrollment is prime time for TPAs to engage employees about their benefits package and the value it provides to them.

Enrollment Season: How to Increase Benefits Account Adoption

The most pervasive reasons why employers and benefits administrators struggle to increase account adoption by employees include a lack of benefits education, personalization, and positioning.

Education and Continued Engagement

Employee education is arguably the most important factor influencing account adoption. Nearly two-thirds of healthcare professionals (63%) cite education as the biggest barrier to adopting healthcare benefit accounts; more than half (53%) say employers are responsible for educating consumers about these benefits.

Healthcare benefits can be complicated and confusing, thanks to complex terminology and rules about eligibility and spending. Half of employees either do not understand their benefits or experience confusion about how their benefits work. For example, think about carryover for FSAs vs. rollover – the terms are very similar, but have different meanings.

Another example involves HSA accounts. To be attracted to this benefit option, employees need to understand high deductible health plans (HDHPs), how they help lower premium costs, the triple tax savings that HSAs offer, and account balance building strategies. Better yet, if HSA funds aren’t used right away, the accounts can be saved for later use even when no longer enrolled in an HDHP. A “How does this benefit me?” type of educational approach can be very effective in promoting HDHP and HSA enrollment.

Enrollment forms and educational booklets are also an important factor during open enrollment. Where does the needed information appear? Is it at the beginning or end? An employee who is already making a number of deductions prior to getting to the FSA or HSA information may feel overwhelmed and be less likely to participate or may not take full advantage of the benefit account.

Finally, employees can also benefit from an easily accessible, year-round engagement program that provides periodic education on how the accounts work both during open enrollment and throughout the plan year.

Personalization (aka “Know Your Audience”)

A crucial piece in increasing account adoption lies in understanding the employee audience. In other words, know who you are talking to and how best to approach them. Currently, the American workforce is primarily made up of four distinct generations:

Baby Boomers are by nature interpersonal and prefer face-to-face communications; if they cannot talk with someone in person, they like being able to use the telephone (as opposed to email) to get answers. Boomers also tend to prefer printed materials to reading online.

Generation X is the most flexible generation. Interpersonal communications suit them well and most are very comfortable with digital technology. Gen-Xers are also fine with printed materials, videos, emails, texting or telephone calls to receive information.

The Millennial generation is quite different than Boomers or Gen-X. To reach them effectively, TPAs should consider a digital approach, since this group tends to avoid in-person communications like phone calls and face-to-face meetings to get their information. Instead, Millennials prefer short, to-the-point content delivered by email, social media, websites, and text messaging.

Generation Z is the first digital-native generation. They consume information in short, brief narratives delivered through social media, email, online and texting.

Employers must also take into account the socioeconomic factors of their audience. A blue-collar workforce typically

will absorb information differently than white-collar employees and may have different personal goals that affect

their benefits choices.

Be Flexible

There is no one-size-fits-all approach to employee education. Each employer’s culture is different. In addition, you may not be able to meet in person with your groups. Consider recording each individual benefits discussion and making it available for each group. Posting the video and related enrollment materials to a secure webpage allows employees to digest the material at their own pace and refer back as needed for a refresher. Keep your email and phones open to answer questions.

Cost Considerations

Among the chief concerns for employees is cost. How much does the benefit cost compared to how much the employee can use it?

Health Reimbursement Arrangements (HRAs) are solely employer-funded for participant healthcare expenses. Depending on plan design, there is no cost for the participant and they receive maximum benefit. Not surprisingly, HRA plans typically experience high employee enrollment.

With that in mind, employees may be more likely to adopt an FSA or HSA that features some form of employer seeding. IRS regulations allow anyone (including employers) to contribute to these accounts, with the total amount applying toward the employee’s annual contribution limit.

Employers who seed employee accounts normally experience a modest increase in HSA enrollment. When employees have medical plan choices, 40 percent will choose an HSA when the employer contributes, compared to 35 percent when the employer does not contribute.

Conclusion

Increasing account adoption is beneficial for each party involved. TPAs and brokers enjoy happier employer clients and can increase client loyalty. In addition to cost savings and higher productivity, employers look better to potential new hires and can retain top talent. Meanwhile, employees feel more satisfied and experience less financial and healthcare-related stress.

However, to achieve these goals, brokers and TPAs must understand who they are talking to and how to appeal to their audience. For some companies, it may take a little more convincing in order for them to adopt a more robust and higher quality benefits package that their employees will appreciate. Employees, once they understand how their benefits work and how to maximize their usefulness, will be more likely to sign up and adopt their employer’s plan. In the end, this can help lower the cost of healthcare, increase financial wellness, boost morale, and lower turnover in the workplace.

Questions to Ask

- Are your employer clients happy with their benefits package?

- Does the employer understand the advantages of a robust benefits package?

- Do your employer clients understand the needs of their workforce?

- What is the enrollment rate among your clients’ employees?

- What types of enrollment materials are you using to convey information?

- Do you use videos, digital or printed materials, or social media, to promote benefits education?

- Can your groups easily access the necessary information? Can they contact your office with questions?