Health Reimbursement Arrangements (HRAs) are a flexible tax-advantaged vehicle to help employers save money while delivering a strong benefits package for their workforce. The IRS allows extraordinary flexibility for HRAs, which means companies can find creative ways to reduce their healthcare expenses and tax burden while still offering competitive benefits.

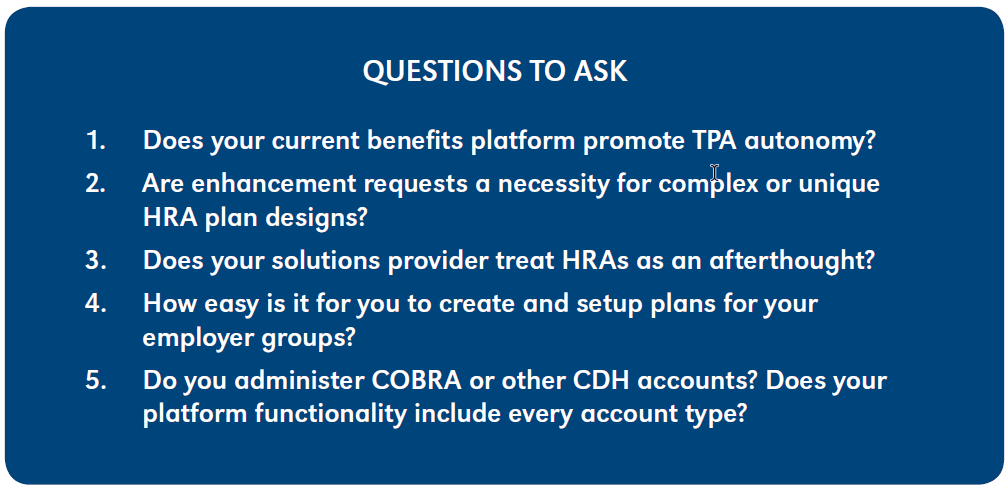

The challenge for third party administrators is finding a benefits administration solution in the HRA market that enables them to attract and retain clients, deliver superior service, and create flexible and complex HRA plans without overbearing constraints from their solutions provider.

Background of Health Reimbursement Arrangements

First offered by employers in 2001¹, Health Reimbursement Arrangements are part of the ‘big three’ of consumer directed healthcare (CDH) accounts, alongside Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA). According to a 2018 study conducted by the Society for Human Resource Management, about 20 percent of respondents have access to an HRA.²

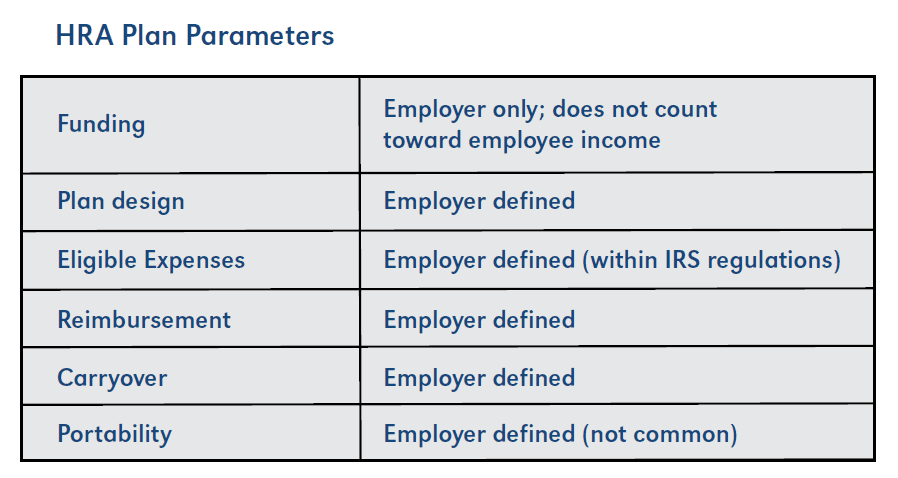

As part of CDH benefit account options, HRAs differ from their counterparts by offering the greatest amount of flexibility for employers and employees. For example, the account is not tethered to a specific type of health plan like an HSA, nor is there a cap on annual election amounts like with an FSA and HSA. Another difference is that HRAs are solely funded by the employer with a couple of notable government restrictions. High level parameters for an HRA include:

One restriction concerns eligible expenses, which must be IRS-approved, but the employer has the freedom to pick and choose which expenses to cover. The other restriction is that under Affordable Care Act (ACA) guidelines, a large employer HRA is considered a group health plan and cannot be used to cover insurance premiums (a Qualified Small Employer HRA allows for insurance premiums under certain parameters).³ These restrictions may not be permanent, though, as recent moves by President Trump’s administration could eliminate the restriction on paying for health insurance premiums, further expanding HRA demand and the HRA market.

Ultimately, Health Reimbursement Arrangements allow the employer to save significant amounts of money through reduced insurance premiums while offering its workforce healthcare benefits. Given this freedom, an employer could demand creative HRA plan designs in order to maximize their benefits with donut hole plans, multi-tier plans, or post-tax HRA reimbursement, or a whole host of other benefit options.

TPA Challenge in the HRA Market

With the extensive freedom allowed by HRA plan designs, the challenge for third party benefits administrators in the HRA market is to find an administrative solution that can meet employer demands for creative and often complex reimbursement arrangements without sacrificing flexibility or quality of service.

Solution Options: The Enhancement Request Model

Finding the right benefits administration solutions partner is a challenge, especially when trying to find a partner that can provide the necessary tools for TPAs to meet their clients’ needs. Different solutions emphasize different capabilities. Any administration platform with HRA functionality should be able to handle a ‘plain vanilla’ plan design. A more advanced solution, however, is required to easily handle many different setups across a wide scope of complexity.

Some solutions providers in the HRA market tout the number of plan designs they have available, but what does that actually mean for a TPA with a unique request? Can the TPA independently design the unique request in the administration solution? Or are they required to wait for the solutions provider to build it for them through an enhancement request? A solution that relies on reactive, rather than proactive, development of HRA functionality presents benefits administrators a number of critical items to consider.

Vendor dependence – TPAs need to be focused on running their day-to-day operations, not worried about functionality that limits operations. In the enhancement request model, the TPA is dependent on the solutions provider rather than utilizing a solution that helps them stay head of the curve and remain highly competitive in their market.

Restricted business development – An HRA-focused TPA who uses a solution that is not equipped to handle their clients’ HRA needs can face stifled revenue opportunities. Businesses that rely on complex HRAs as part of their benefits package will seek a TPA who can deliver the best experience for the company and its employees.

Clumsy enhancement request process – While a solutions provider may claim they offer an impressive number of plans, what does it take to get those plans created?

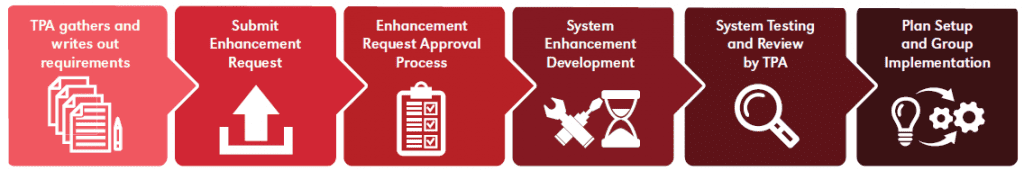

Example of complex process to create plans:

- Gather plan requirements from the employer.

- Test the system to see if it can accommodate the exact plan design.

- If the system can’t accommodate the plan design, then the TPA must submit an enhancement request to the solutions provider by filling out a long and very detailed form.

- Once the request is submitted, it has to be approved, then put in the production schedule. That could mean an additional 4-6 weeks for development, before the TPA can even review to see if the functionality meets requirements.

- TPA review – does the plan meet specifications? Does the functionality work? If not, the request is sent back, deferring implementation even further.

Slowed production – While the enhancement request is being worked, the employer is on hold for its benefits plan. Meanwhile, the TPA has to turn its attention to other clients and to come back later to implement the complex HRA – a frustrating back-and-forth process for everyone involved.

Lengthy implementation – Once the plan is approved and the enhancement request complete, the TPA can then implement the group in the system. Companies and their employees may experience delayed benefits as a result.

Mediocre customer service – A solutions provider may have reliable customer support practices for standard operations, but when a TPA gets into a special situation, can the vendor’s support team deliver the same level of service? If they aren’t familiar with the plan design or how the system accommodates it, resolution time and client experience will be impacted.

Another Option: Flexible HRA Solution

TPAs who specialize in HRA administration or generate a significant portion of their business working with HRAs need a solution with their special business needs in mind. An ideal platform should allow:

Greater TPA autonomy – TPAs need the independence to run their businesses however they see fit to meet the unique needs of their clients and their market. Relying on the solutions provider every time an unusual plan type comes along is far from optimal. A solution that enables TPAs to create their own complex plans promotes greater independence from the vendor and provides them with an enhanced competitive advantage in the HRA market.

No enhancement request – A flexible platform that allows unlimited plan design and does not require an enhancement request to develop a specific plan boosts productivity and streamlines efficiency.

Increased revenue and marketing potential – A TPA with a reliable complex HRA solution has a greater chance of attaining and keeping a strong revenue stream over those who use a system that requires constant and cumbersome functionality requests.

Easy plan setup – A software solution developed to facilitate flexible plan creation with nearly unlimited variables helps the TPA to remain competitive and deliver superior customer service to their clients.

Quicker implementation – The ability to create HRA plans on demand that meet the needs of employers translates into quicker implementation and onboarding times. This can reduce stress and headaches, and produce a more positive experience for everyone involved.

Improved customer service – When a TPA has a question for their platform provider, a customer service team with thorough knowledge of how complex plan types work within the administrative solution can respond more quickly and more accurately than a service rep that has to research custom development work.

Conclusion

Health Reimbursement Arrangements are a staple of consumer directed healthcare and should continue to remain a viable and growing revenue stream, especially if market and government forces combine to increase demand. As such, custom plan development through enhancement requests is slow and costly and fails to meet the needs of third party benefits administrators and their clients. As employers look to save on healthcare costs and offer strong benefits packages to attract and retain talent, TPAs who specialize in HRAs need a solution that can accommodate all plan designs – not just simple, run-of-the-mill HRAs. Finding a benefits administration solutions partner who places as much value on its HRA functionality as it does on FSAs and HSAs is crucial.

¹ Health Savings Accounts and Health Reimbursement Arrangements: Assets, Account Balances, and Rollovers, 2006–2014, EBRI.org

² 2018 Employee Benefits Survey, Society for Human Resources Management (SHRM)

³ Section 213(d), Internal Revenue Code

About the Company:

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.