Always an intense and stressful time for brokers, TPAs, and employers alike, enrollment season for the 2023 plan year promises to be even more so. As COVID-19 gradually transitions from pandemic to endemic, its impact on Americans cannot be denied. By mid-2022, more than 90 million had contracted COVID-19, with over a million confirmed deaths. How can we successfully address the past two years’ influence on our workplaces and workforce?

It will take more than putting a new facade on the same old benefits package. To attract and retain employees, enrollment season 2023 must include creative benefits that focus on employees’ physical, mental/emotional, and financial health needs.

The Workplace Has Changed

COVID-19 continues to have enormous repercussions in the American workplace. We are changing jobs and working remotely at unprecedented rates. Since March 2020, when the pandemic began, the U.S. has realized more than 102 million job resignations – and the pace has yet to slow, with 4.2 million more in June 2022. American employers are struggling to fill job openings, and the tight labor market is affecting the availability of products and services.

American businesses had over 10.7 million job openings in June 2022, in the face of only 5.9 million people among the ranks of the unemployed. Although many employed people can work multiple jobs, these numbers help highlight the problem.

A Deloitte study from 2021 surveyed Fortune 1000 company leaders about how they responded to the labor shortage. Among the findings:

- 57% of CEOs believed attracting talent was among their most significant challenges

- 35% had already expanded benefits to help increase retention

Since experiencing pandemic-related remote working, about 16% of American companies have already converted permanently to 100% remote working. It is estimated that 36.2 million Americans will work at least part of the time remotely by 2025.

Workers Have Changed Even More

But the changes to workers are perhaps even more dramatic than those to the workplace. The pandemic has fundamentally affected American attitudes toward work. Workers battled burnout, fatigue, and anxiety. Social distancing and shutdowns saved lives and resulted in strained family relationships, waning friends, and missed life events.

From work location and scheduling flexibility to the benefits they are looking for, employees now expect more from their employers – and have proven that they are willing to change jobs to meet those expectations.

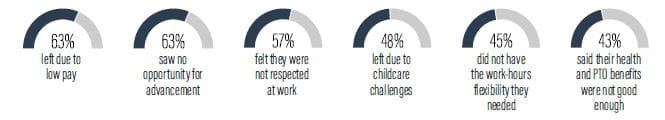

In fact, among employees who quit their jobs during the Great Resignation, 45% included a lack of flexibility in working hours among the reasons, and 43% said their health and PTO benefits weren’t good enough.

Among those voluntarily leaving their jobs in 2021:

Before the pandemic hit, the American economy grew steadily, unemployment was low, and socio-political stability was relatively secure. In addition to standard benefits, employers were offering cool perks such as onsite ping-pong tables, climbing walls, coffee baristas, and free lunches to stand out in the labor market and attract workers. However, perks like these have lost much of their previous value and appeal.

What Employees are Looking For

Employees are unable, or at least unwilling, to return to the way it was. According to PricewaterhouseCoopers (PwC), employers must face reality and adapt to it by focusing on retaining employees and rebuilding company culture.

Workers are now far more interested in benefits that protect their security and enhance their overall well-being. In their 2021 study on how companies need to rethink their responsibilities toward employees, MetLife found that concerns over well-being affect productivity in over half of employees.

Employees are looking for their employers to provide benefits that address three key areas:

Physical health

Thanks to COVID-19, physical well-being benefits are valued more than ever – even among the younger generations, who have historically valued healthcare less than older adults. Many were hit with unexpected medical expenses during the pandemic.

Mental/emotional health

The desire for mental/emotional health and well-being benefits has also increased. The Employee Benefits Research Institute (EBRI) found in 2021 that half of all employees think mental health wellness programs are now more critical than ever8. Most striking, however, is that one in five employees (20%) said that increased assistance with mental health and emotional well-being would be the single most valuable improvement to their employer’s benefits package.

Financial health

Concern for financial well-being has soared. The pandemic caused substantial hardship, particularly among gig workers and those in industries that don’t translate well to remote working. Others observed how quickly their financial situation could change due to forces beyond their control. Inflation and wage stagnation have also significantly reduced employee purchasing power. Debt is growing faster because employees have less cash to use in paying it down.

Benefits That Focus on Well-Being

Employees want employers to help protect their holistic well-being so they can feel safe, protected and prepared across physical, mental/emotional, and financial areas.

Benefits account for just over 31% of an employee’s total compensation package. Companies can and should leverage their employee benefits programs to attract and retain employees. The American Institute of Certified Public Accountants (AICPA) found that 80% of Americans favor benefits over extra salary. Over half of U.S. workers (55%) left jobs after finding better benefits elsewhere.

As you prepare for the 2023 enrollment season, approach your traditional benefits with fresh eyes and take advantage of creative opportunities to expand your benefits package. Doing so can help you overcome many challenges posed by an incredibly tight labor market and set your company apart from others hiring out of the same competitive labor pool.

Creative Benefit Strategies

Promote Physical Well-Being

Flexible Spending Account (FSA)

Over 30% of employers still do not offer any Flexible Spending Account (FSA). To help with employee physical well-being, offer a full FSA for various healthcare expenses, or a Limited Purpose FSA (LPFSA) for just vision and dental care.

Health Reimbursement Arrangement (HRA)

Employers who have not sponsored a group plan in the past or are having difficulty affording one now should consider offering an Individual Coverage Health Reimbursement Arrangement (ICHRA) or Qualified Small Employer Health Reimbursement Arrangement (QSEHRA). These accounts can help employees acquire individual healthcare coverage on either the healthcare exchange or the open market. Reimbursement for out-of-pocket healthcare expenses can also be included if desired.

Health Savings Account (HSA)

Employers help keep their group health insurance costs down by adopting HSA-eligible health plans with higher deductibles and HSAs. Employers not already seeding employee HSAs each year should begin doing so. The average employer contribution is $500-$750 for single coverage, depending on company size. Employer contributions encourage employee participation (typically a 5% increase in the employee adoption rate) and spark increases in employee contributions.

Lifestyle Spending Account (LSA)

LSAs can contribute to physical well-being by helping employees access products and services such as gym memberships, fitness equipment, weight loss programs, and many other options. The employer decides which expenses are eligible and whether employees will be offered a debit card to access the funds or have to pay out of pocket and then submit a receipt for reimbursement.

In addition to promoting their physical well-being, FSA, HRA, and HSA accounts also promote financial health by helping employees save payroll taxes on the amounts set aside – up to 30-40%, depending on their tax brackets. The sponsoring employer gets the business expense deduction and a reduction in FICA matching taxes.

Nurture Mental/Emotional Well-Being

Flexible Spending Account / Health Savings Account (FSA/HSA)

Even if the employer has offered FSAs and HSAs for some time, they should educate employees about using FSA/HSA funds for counseling therapy (including telehealth), substance abuse treatment programs, and similar sources of assistance with mental and emotional health. Even after having one of the accounts for several years, participants are often surprised to realize that a particular expense is eligible for these accounts.

Health Reimbursement Arrangement (HRA)

If the employer offers an HRA, ensure mental health is included among the healthcare expenses eligible for reimbursement. If not already included, consider adding a telehealth counseling option to the list of qualified expenses.

Lifestyle Spending Account (LSA)

LSA accounts can promote mental and emotional well-being by helping employees pay for services such as marital counseling, meditation apps or classes, and life coaching. Weekend getaways, date-night babysitting services, and many other activities that can be made available under LSAs also help employees deal with stress, anxiety, and burnout.

Encourage Financial Well-Being

Health Savings Account (HSA)

Educate your employees about HSA tax benefits and investment features that contribute toward their financial well-being both now and in the future.

Student Loan Reimbursement Account (SLRA)Many employees are burdened by high student loan debt. Employers can help by sponsoring an SLRA. Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020, employer SLRA payments are not taxable to the employee but remain a business expense write-off for the employer. Through 2025, employers can make up to $5,250 annually, matching employee student loan debt payments.

Lifestyle Spending Account (LSA)

Have you noticed just how versatile Lifestyle Spending Accounts can be? They help with physical, mental/ emotional, AND financial well-being. For the latter, employers can set up the LSA to cover financial planning services, budgeting classes, savings apps, will preparation, and more.

Emergency Savings Account (ESA)

A recent survey by the Federal Reserve found that about 40% of American adults would struggle to pay an unexpected $400 bill without having to rely on credit. Employer-sponsored ESAs automatically deduct a small amount from each participating employee’s payroll before it is direct-deposited. The ESA deduction is direct-deposited instead into a separate savings account. Although ESAs have no tax advantages, many people find that an automatic savings process using money that’s never reached their regular bank account is much easier for them.

Takeaways

- American employers are struggling to fill job openings. There were over 10.7 million openings in June, but only 5.9 million among the ranks of officially unemployed. Although many employed people can work multiple jobs, these numbers highlight the tight labor market.

- The pandemic has fundamentally affected the attitudes of the American labor force toward work. From location and schedule flexibility to the kinds of employee benefits they are looking for, workers now expect more from their employers, and they have proven that they are willing to change jobs to get what they want.

- Employees want their employers to help protect their holistic well-being so they can feel safe, protected, and secure in three key areas: Physical Health, Mental/Emotional Health, and Financial Health.

- In addition to re-educating employees on the advantages of FSA and HSA accounts and considering different types of HRA accounts, employers should consider creative benefit accounts such as Lifestyle Spending Accounts (LSAs), Student Loan Reimbursement Accounts, and programs (SLRA/SLRP), and Emergency Savings Accounts (ESAs).

- Benefits account for just over 31% of an employee’s total compensation package. Over half of U.S. workers have left jobs after finding better benefits elsewhere.

- The American Institute of Certified Public Accountants (AICPA) found that 80% of Americans favor benefits over extra salary. Companies can and should leverage their employee benefits programs to attract and retain employees.

- In preparing for the 2023 enrollment season, companies should expand benefits programs creatively and emphasize the versatility of benefit accounts to set themselves apart from other firms hiring from the same labor pool.

As you finalize your employer benefit packages, take a moment to ensure you are getting creative this post-pandemic enrollment season.

About the Company:

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.