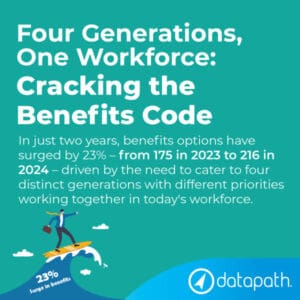

In just two years, benefits options have surged by 23% – from 175 in 2023 to 216 in 2024 – driven by the need to cater to four distinct generations with different priorities working together in today’s workforce.

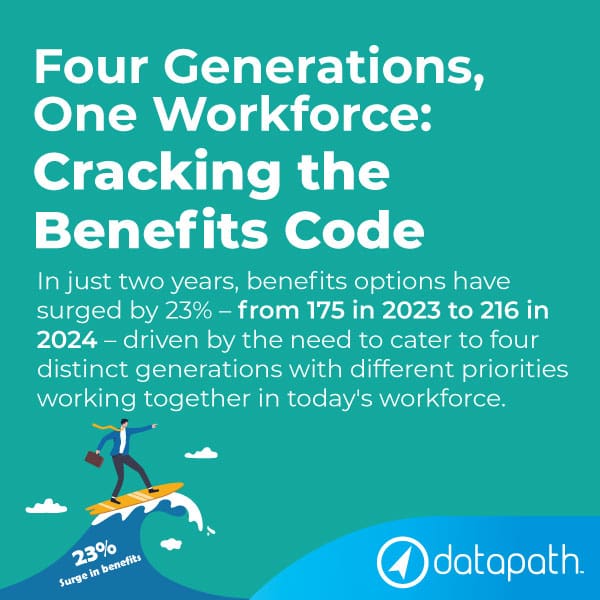

Generation Z: Realistic Innovators

BORN: 1997-2012

FOCUS: Wellness and Flexibility

Members of Gen Z, also called Zoomers, have been shaped by global connections, social media, and economic uncertainty. As digital natives, they work to build personal brands while keeping realistic career and financial goals. Zoomers approach work with a practical mindset, understanding economic ups and downs, and seek employers who balance stability with innovation.

Gen Z wants mental health support and flexible work options. They see these as essential, not just perks. They use digital tools effortlessly and expect technology to integrate smoothly into their work, from benefits enrollment to daily chats. This generation values diversity, inclusion, and social responsibility, urging employers to support these ideals with real actions and benefits. Their concerns go beyond pay; they include holistic wellness, student loan help, and workplaces that reflect their values.

To connect with Gen Z, benefits professionals must recognize their mix of idealism and pragmatism – that they aim to make a difference while securing their financial futures in an uncertain economy.

TOP PRIORITIES:

● Mental health (more than any previous generation)

● Flexible work arrangements (as a core benefit, not a perk)

● Managing student loan/educational debt burden

KEY STATS:

● Currently 18% of workforce; 30% by 2030

● 77% of large employers report increased worker mental health needs

Millennials: Purpose-Driven Optimizers

BORN: 1981-1996

FOCUS: Purpose and Growth

Now in their late 20s to early 40s, Millennials make up over a third of U.S. workers. They began their careers during or just after the 2008 financial crisis and have since navigated their prime earning years through a global pandemic. This journey has shaped their views on work, pay, and the employer-employee relationship.

Millennials seek purpose and values in their jobs. Digital integration and meaningful work are key. Instead of traditional work-life balance, they want careers that align with their values and offer flexibility. Top priorities include professional growth, social impact, and fair pay with benefits. Financial wellness programs are essential for managing student loan debt, saving for a home, and planning for retirement.

To attract Millennials, benefits professionals must offer comprehensive packages. These should address immediate financial needs and support their long-term career goals.

TOP PRIORITIES:

● Continuous learning/career advancement opportunities

● Financial wellness (balancing debt with retirement planning)

● Meaningful work integrated with personal values and lifestyle

KEY STATISTICS:

● More than a third of the workforce (the largest segment)

● 66% say benefits are equal to or more important than salary

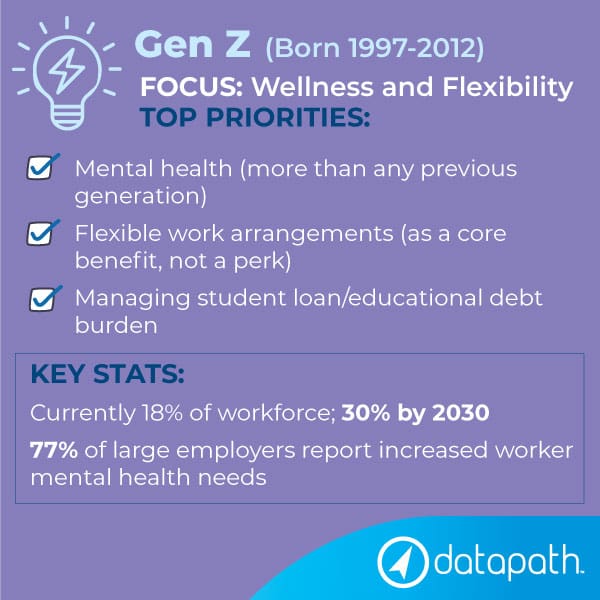

Generation X: Pragmatic Balancers

BORN: 1965-1980

FOCUS: Practical Support

Generation X, now in their 40s and 50s, are the “sandwich generation” and find themselves caring for aging parents while also supporting their own children. This dual role creates financial and time pressures that shape their benefits priorities. Having seen corporate downsizing, multiple recessions, and the decline of traditional pensions, Gen X approaches workplace promises with skepticism. They prefer practical, proven benefits over flashy perks.

Gen X values independence and self-reliance. They balance career goals and family duties. Their experiences with economic turmoil have made them resourceful and adaptable. This has heightened their focus on financial security and practical support systems. They want benefits like flexible spending accounts and dependent care assistance, along with career development that fits their family obligations.

Benefits administrators must provide tools that offer flexibility and control. This helps Gen X manage family healthcare needs, maximize retirement savings, and keep their careers on track. They seek clear communication and benefits that provide real value.

TOP PRIORITIES:

● Dependent care (both children and aging parents)

● Flexible spending accounts (tools for managing family healthcare costs)

● Retirement (maximizing remaining earning years)

KEY STATISTICS:

● Over 30% of the workforce

● Only 43% are satisfied with their current benefits package

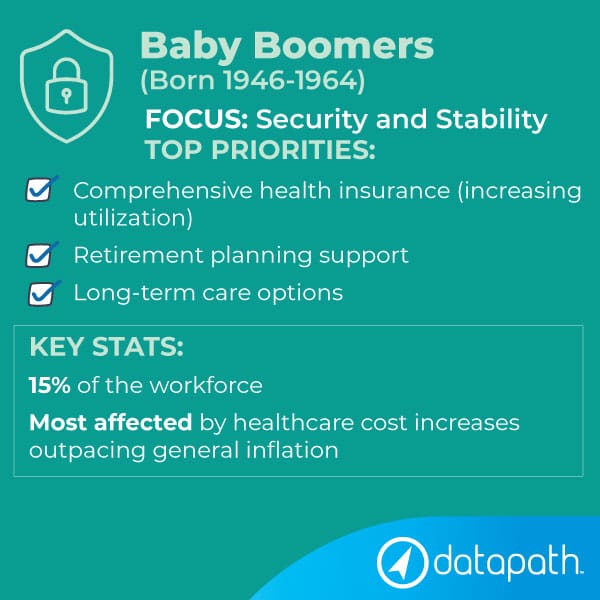

Baby Boomers: Security Seekers

BORN: 1946-1964

FOCUS: Security and Stability

Baby Boomers, now in their 60s and 70s, make up 15% of the U.S. workforce. Many still work despite reaching retirement age, whether due to financial needs, a desire to stay active, or to earn extra income.

Boomers are known for their strong work ethic and dedication to career growth. They prefer face-to-face communication and traditional management styles. After years of working and saving, they now face the challenge of funding a long retirement, especially with rising healthcare costs. Top priorities include comprehensive health insurance, solid retirement planning, and long-term care options. Job security and established benefits are also very important.

Benefits professionals must understand Boomers’ need for stability and clear guidance as they shift from saving for retirement to securing their retirement. Boomers expect personalized help with Medicare, Social Security, and healthcare cost management. They seek practical insights to enhance their retirement security.

TOP PRIORITIES:

● Comprehensive health insurance (increasing utilization)

● Retirement planning support

● Long-term care options

KEY STATISTICS:

● 15% of the workforce

● Most affected by healthcare cost increases outpacing general inflation

Want some deeper insights into generational benefit preferences? Dive into our recent whitepaper:

“Generational Differences in Employee Benefits: Insights for Benefits Professionals and HR Leaders“