Lifestyle Spending Accounts are one of the newest benefit options third-party administrators can offer. This infographic will help educate employers and participants on LSA accounts.

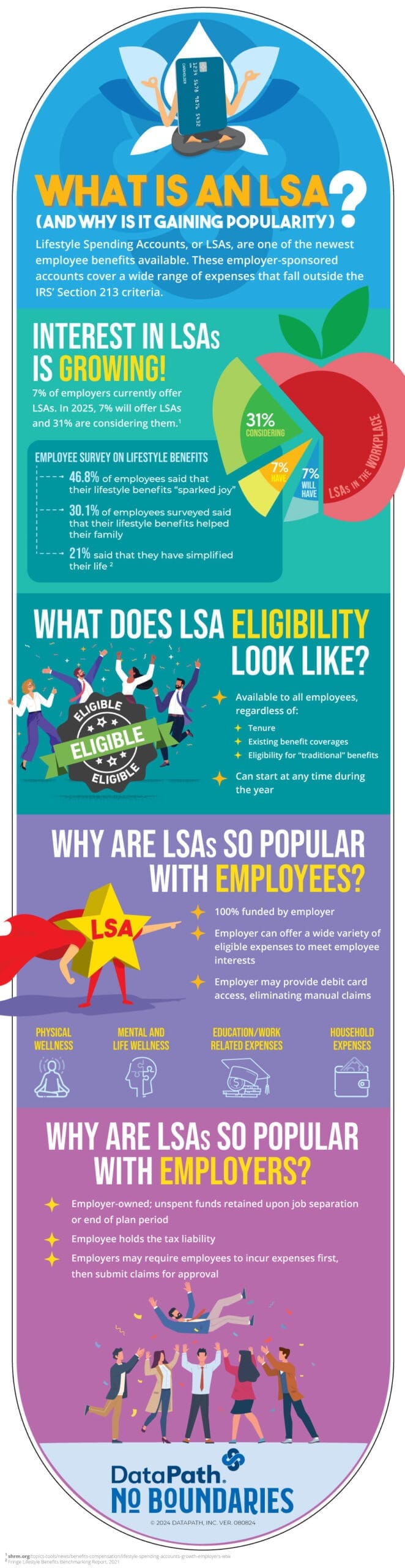

Lifestyle Spending Accounts, or LSAs, are one of the newest employee benefits available. These employer-sponsored accounts cover a wide range of expenses that fall outside the IRS’ Section 123 criteria.

Interest in LSAs is growing!

7% of employers currently offer LSAs. In 2025, 7% will offer LSAs and 31% are considering them.

Employee Survey on Lifestyle Benefits1

- 46.8% of employee said that their lifestyle benefits “sparked joy”

- 30.1% of employees surveyed said that their lifestyle benefits helped their family

- 16.1% surveyed said their lifestyle benefits reduced their stress

What does eligibility look like?

- Available to all employees, regardless of:

- Tenure

- Existing benefit coverages

- Eligibility for “traditional” benefits

- Can start at any time during the year

Why are LSAs so popular with employees?

- 100% funded by employer

- Employer can offer a wide variety of eligible expenses to meet employee needs and interests

- Employer may provide debit card access, eliminating manual claims

Why are LSAs so popular with employers?

- Employer-owned: unspent funds retained upon job separation or end of plan period

- Employee holds the tax liability

- Employers may require employees to incur expenses first, then submit claims for approval

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.

- Fringe lifestyle Benefits Benchmarking Report 2021, as reported by Compt.io Workplace Trends ↩︎