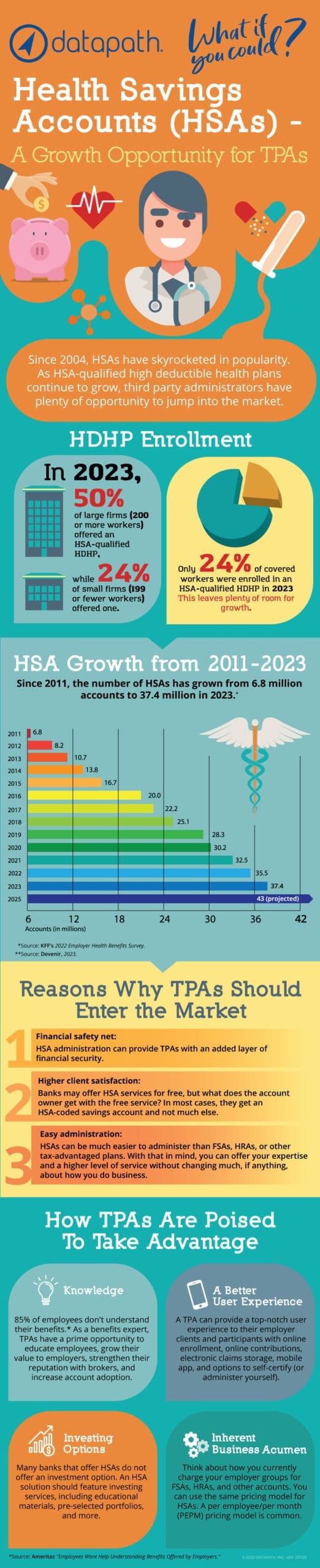

The following infographic highlights HSA growth opportunity for third party administrators. Since 2011, Health Savings Account (HSA) adoption has grown almost 425 percent.

Health Savings Accounts (HSAs) – A Growth Opportunity for TPAs

Since 2004, HSAs have skyrocketed in popularity. As HSA-qualified high deductible health plans continue to grow, third party administrators have plenty of opportunity to jump into the market.

HDHP Enrollment

- 51% of large firms (200 or more workers) offered an HSA-qualified HDHP

- 24% of small firms (199 or fewer workers) offered one

- Only 24% of covered workers were enrolled in an HSA-qualified HDHP in 2020

There is plenty of opportunity for HDHP and HSA growth.

HSA Growth from 2011-2022

- 2011: 6.8 million accounts

- 2012: 8.2 million accounts

- 2013: 10.7 million accounts

- 2014: 13.8 million accounts

- 2015: 16.7 million accounts

- 2016: 20.0 million accounts

- 2017: 22.2 million accounts

- 2018: 25.1 million accounts

- 2019: 28.3 million accounts

- 2020: 30.2 million accounts

- 2021: 32.5 million accounts

- 2022: 35.5 million accounts

- 2025: 43 million accounts (projected)

Reasons Why TPAs Should Enter the Market

- Financial safety net: HSA administration can provide TPAs with an added layer of financial security

- Higher client satisfaction: Banks may offer HSA services for free, but what does the account owner get with the free service? In most cases, they get an HSA-coded account and not much else

- Easy administration: HSAs can be much easier to administer than FSAs, HRAs, or other tax-advantaged plans. With that in mind, you can offer your expertise and a higher level of service without changing much, if anything, about how you do business

How TPAs Are Poised to Take Advantage of HSA Growth

- Knowledge: 85% of employees don’t understand their benefits. As a benefits expert, TPAs have a prime opportunity to educate employees, grow their value to employers, strengthen their reputation with brokers, and increase account adoption

- A Better User Experience: A TPA can provide a top-notch user experience to their employer clients and participants with online enrollment, online contributions, electronic claim storage, mobile app, and options to self-certify (or administer yourself).

- Investing options: Many banks that offer HSAs do not offer an investment option. An HSA solution should feature investing services, including educational materials, pre-selected portfolios, and more.

- Inherent Business Acumen: Think about how you currently charge your employer groups for FSA, HRAs, and other accounts. You can use the same pricing model for HSAs. A per employee per month (PEPM) pricing model is common.

Read our whitepaper “Fear Not: There’s Still Time for TPAs to Enter the Thriving HSA Market.”

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.