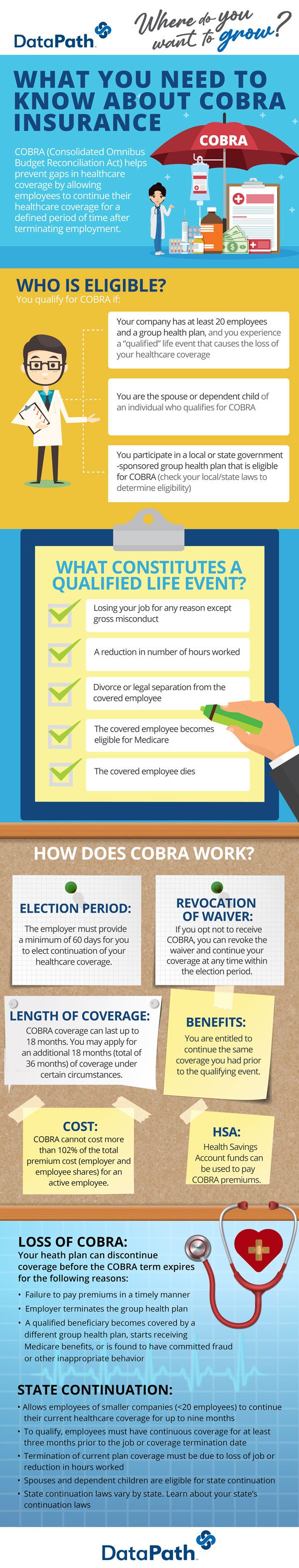

The following infographic explains COBRA insurance need-to-knows.

Need-to-knows include a COBRA overview, eligibility requirements, qualifying life events, State Continuation coverage, and more.

What You Need to Know about COBRA Insurance

COBRA (Consolidated Omnibus Budget Reconciliation Act) helps prevent gaps in healthcare coverage by allowing employees to continue their healthcare coverage for a defined period of time after terminating employment.

Who Is Eligible?

You qualify for COBRA if:

- Your company has at least 20 employees and a group health plan, and you experience a “qualified” life event that causes the loss of your healthcare coverage

- You are the spouse or dependent child of an individual who qualifies for COBRA

- You participate in a local or state government-sponsored group health plan that is eligible for COBRA (check your local/state laws to determine eligibility)

What Constitutes a Qualified Life Event?

- Losing your job for any reason except gross misconduct

- A reduction in number of hours worked

- Divorce or legal separation from the covered employee

- The covered employee becomes eligible for Medicare

- The covered employee dies

How Does COBRA Work?

Election Period: The employer must provide a minimum of 60 days for you to elect continuation of your healthcare coverage.

Revocation of Waiver: If you opt not to receive COBRA, you can revoke the waiver and continue your coverage at any time within the election period.

Length of Coverage: COBRA coverage can last up to 18 months. You may apply for an additional 18 months (total of 36 months) of coverage under certain circumstances.

Benefits: You are entitled to continue the same coverage you had prior to the qualifying event.

Cost: COBRA cannot cost more than 102% of the total premium cost (employer and employee shares) for an active employee.

HSA: Health Savings Account funds can be used to pay COBRA premiums.

Loss of COBRA:

Your health plan can discontinue coverage before the COBRA term expires for the following reasons:

- Failure to pay premiums in a timely manner

- Employer terminates the group health plan

- A qualified beneficiary becomes covered by a different group health plan, starts receiving Medicare benefits, or is found to have committed fraud or other inappropriate behavior.

State Continuation

- Allows employees of smaller companies (fewer than 20 employees) to continue their current healthcare coverage for up to nine months.

- To qualify, employees must have continuous coverage for at least three months prior to the job or coverage termination date.

- Termination of current plan coverage must be due to loss of job or reduction in hours worked.

- Spouses and dependent children are eligible for State Continuation.

- State Continuation laws vary by state. Learn about your state’s continuation laws.

For more on other COBRA insurance need-to-knows, read this COBRA and State Continuation FAQ.

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.