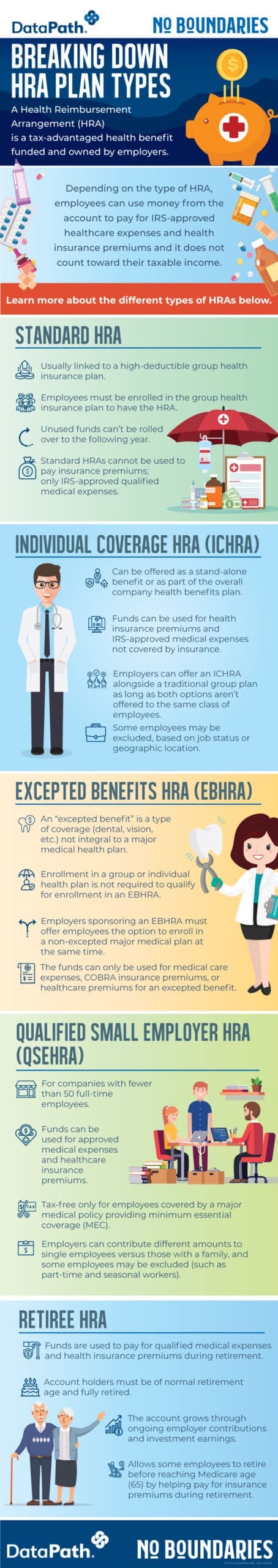

Breaking Down HRA Plan Types

A Health Reimbursement Arrangement (HRA) is a tax-advantaged health benefit funded and owned by employers. Depending on the type of HRA, employees can use money from the account to pay for IRS-approved healthcare expenses and health insurance premiums and it does not count toward their taxable income.

Learn more about HRA plan types:

HRA Plan Types

Standard HRA

- Usually linked to a group health insurance plan

- Employees must be enrolled in the group health insurance plan to have the HRA

- Unused funds can’t be rolled over to the following year

- Standard HRAs cannot be used to pay insurance premiums, only IRS-approved qualified medical expenses

Individual Coverage HRA (ICHRA)

- Can be offered as a stand-alone benefit or as part of the overall company health benefits plan

- Funds can be used for health insurance premiums and IRS-approved medical expenses not covered by insurance

- Employers can offer an ICHRA alongside a traditional group plan as long as both options aren’t offered to the same class of employees

- Some employees may be excluded, based on job status or geographic location

Excepted Benefits HRA (EBHRA)

- An “excepted benefit” is a type of coverage (dental, vision, etc.) not integral to a major medical health plan

- Enrollment in a group or individual health plan is not required to qualify for enrollment in an EBHRA

- Employers sponsoring an EBHRA must offer employees the option to enroll in a non-excepted major medical plan at the same time

- The funds can only be used for medical care expenses, COBRA insurance premiums, or healthcare premiums for an excepted benefit

Qualified Small Employer HRA (QSEHRA)

- For companies with fewer than 50 full-time employees

- Funds can be used for approved medical expenses and healthcare insurance premiums

- Tax-free only for employees covered by a major medical policy providing minimum essential coverage (MEC)

- Employers can contribute different amounts to single employees versus those with a family, and some employees may be excluded (such as part-time and seasonal workers)

Retiree HRA

- Funds are used to pay for qualified medical expenses and health insurance premiums during retirement

- Account holders must be of normal retirement age and fully retired

- The account grows through ongoing employer contributions and investment earnings

- Allows some employees to retire before reaching Medicare age (65) by helping pay for insurance premiums during retirement

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.