Health Savings Accounts (HSAs) were introduced in 2003 as a way to help individuals offset high deductible health plan (HDHP) costs. Since then, they have grown steadily in both the number of accounts and account assets. Yet, despite appealing across demographic groups, HSAs still aren’t as well understood or utilized as 401k plans or IRAs. To some degree the accounts remain an untapped market. As such, growth of HSA accounts may continue exponentially with sufficient promotion and professional management.

HSA Market in 2021

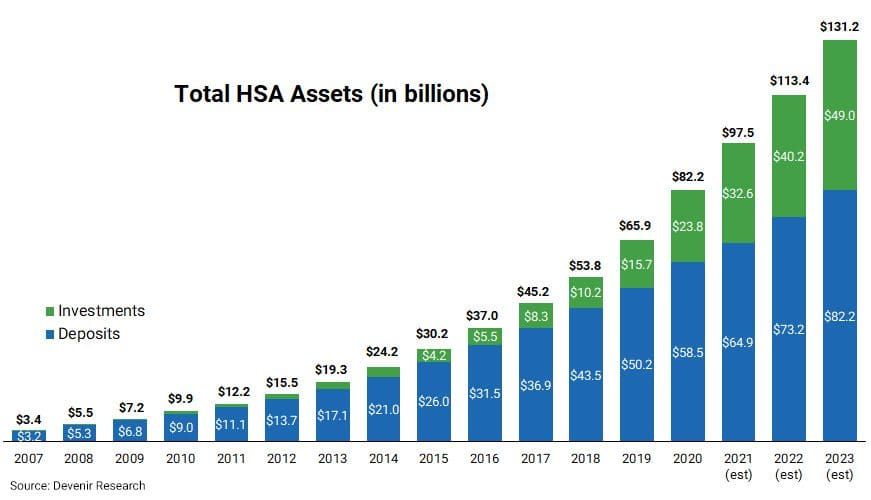

The 2021 Midyear Devenir HSA Research Report reflects the strong growth experienced in accounts, assets and investments:

- HSA savings have grown to over $90 billion. As of June 30, 2021, the number of HSA accounts had reached more than 31 million, holding $92.9 billion in assets. That’s a year-over-year (YOY) increase of 26 percent for assets and 6 percent for numbers of accounts.

- HSA investments have soared. Strong markets have contributed to substantial growth of HSA investment assets. An estimated $30.4 billion was invested at the end of June, a whopping YOY gain of 73 percent. The average HSA owner who invests at least part of their funds has a total balance of $17,954 (deposit and investments combined).

Mutual Benefit for Employers and Employees

As businesses navigate labor and financial challenges, HDHPs are an increasingly attractive way to help employees manage their healthcare. Coupled with an HDHP, HSAs offer benefits for both employers and employees alike. Employers can help workers offset potentially high out-of-pocket costs by sponsoring an HSA program, often coupled with some amount of employer contribution-matching. Employees who open HSAs enjoy a “triple tax advantage,” including tax-free contributions, tax-free withdrawals (when used for qualified medical expenses), and tax-free interest and investment gains. Once the account owner reaches retirement age, they can withdraw HSA funds for any reason without penalty, similar to a 401(k) plan. Finally, there is no “use it or lose it.” Unspent HSA funds roll over continuously from year to year.

The continued growth of HSAs show they are a welcome addition to employer-sponsored health coverage. Providing education on the benefits of HSAs can only help to maximize participation. It is estimated that by the end of 2023, HSA assets will exceed $131 billion. As older workers plan for retirement, and younger generations move up in the workforce, the HSA market is ripe for continued and sustainable expansion. Savvy employers will retain a third party administrator (TPA) to help educate employees and support growth in HSA participation for maximum benefit.

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.