Since the beginning of employer-employee relationships, the employer has traditionally been in control – deciding worker positions and salaries and when, where, and how long they worked. The realities of having bills to pay kept many workers in one spot for decades, even when unhappy with company management or policies.

The loyalty between workers and employers in both directions has shifted dramatically since the days when companies gave out gold watches for a lifetime of service. Rather than being dismayed by these power shifts, employers that evolve with them may be surprised by how well their companies perform.

TPAs and brokers who help employers align with changing employer-employee dynamics can find new growth opportunities for themselves in the process.

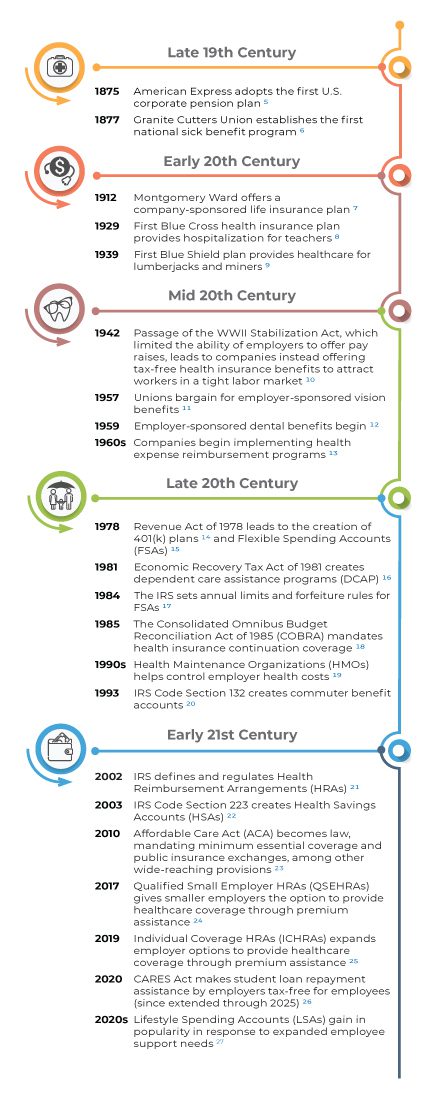

Evolution of Work-Related

Benefits

Workplace benefits are thought to have begun in 13 BCE when Caesar Augustus, trying to stave off the potential for rebellion, extended a lump-sum pension to retiring legionnaires (soldiers) equal to 13 times their salaries.

The next significant advance in employer-sponsored benefits came in 1739 when the Bank of England launched a pioneering private-sector pension plan.

As trade and labor unions took hold in Europe and the U.S. in the 19th century, companies were held not only accountable for working conditions but also increasingly responsible for the health and welfare of their workforce both on and off the job.

Changing Employer-Employee Dynamics

The average U.S. adult works for more than 40 years, and there was a time when working for the same company for an entire career was not uncommon. By 2016, though, only 28% of older workers (ages 55 and up) had been with their current employer for 20 years or more. The average adult now works 12 different jobs over their lifetimes.

The timeline to the right exhibits how employers have become increasingly involved since the 19th century in facilitating employee health and welfare – and, in many cases, underwriting at least a portion of the cost.

COVID-19 strained and tested the employee-employer relationship in many ways. Employers were called on to support employee livelihood, health, and dignity to degrees never before experienced. Decades of further evolutionary change were effectively compressed into a span of about two years.

When the pandemic hit, some companies had to lay off or furlough their workforce; others sent employees to work from home. For the first time, many workers found themselves regulating their own time and energies without employers doing it for them.

Companies who lost valued employees during the Great Resignation or who continue losing the competition for quality new talent have to realize that the balance of power has recently shifted more towards the employee. As workers assume more influence in the employee-employer dynamic, employers need to develop effective and strategic responses that address employee concerns while also balancing associated costs.

Benefit programs should play a significant role in this response. Employees battling anxiety, fatigue, and stress-related burnout have fundamentally changed in their attitudes toward work and employers. From the location in which they work, to the flexibility of their schedules, to the benefits they look for, employees now expect more from the companies that employ them – and through the Great Resignation and otherwise, have proven they are willing to change jobs to get those expectations met.

Workers are now far more interested in benefits that protect their security and enhance their overall well-being. They are not just looking for, but expecting and even requiring their employers to provide benefits that address their physical, mental, and financial well-being.

How can employees be so demanding? What happened to the days when they felt grateful to have a job?

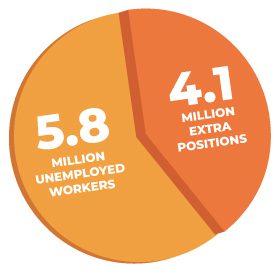

Lots More Jobs, Many Fewer Employees

The U.S. Chamber of Commerce reported in May 2023 that American companies continue to face unprecedented challenges in finding enough workers to fill job openings. This includes companies of every size and industry in nearly every state. The Chamber cites recent data showing 9.9 million U.S. job openings but only 5.8 million unemployed workers.

As the pandemic eased, U.S. employers added a record-setting 4.5 million jobs to the economy in 2022. But many of the 30 million Americans who lost their jobs at least temporarily during the pandemic have chosen not to return to work. The Chamber estimates that, compared to February 2020 (the last full month before the National Emergency began), three million fewer Americans now participate in the labor force.

The net effect of these changes is that the competition to secure prospective employees can be intense. Often, the benefits offered by employers is the deciding factor in a worker's decision to accept a job offer. But not all benefits are valued equally among potential employees.

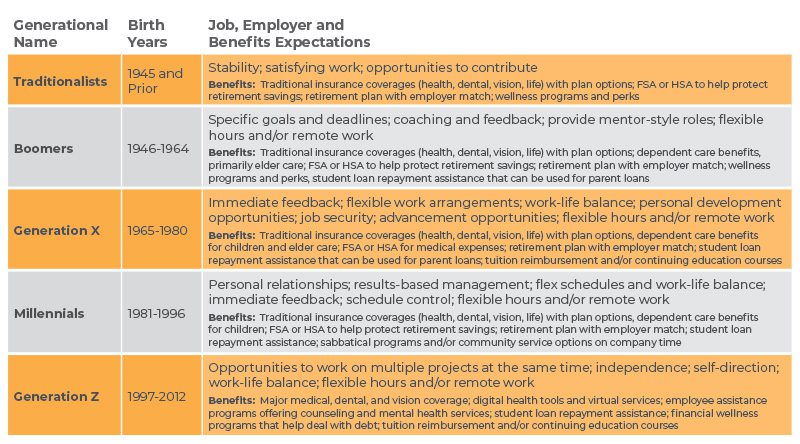

Different Generations, Different Benefit Expectations

Much has been made about there being four different generations in the current U.S. workforce. With people living and staying active longer, some authorities count five different workforce generations – including people born before the end of World War II, who are now in their late 70s and early 80s. One in 20 Americans aged 80 and up was still working as of 2022. Each generation looks for significantly different characteristics in their employers, even before benefits are considered.

Employers face a significant challenge meeting such diverse expectations while controlling costs. However, there are commonly available benefits options that can help address these expectations while also saving money for both the employer and the employee.

Strategic Benefit Options for Changing Employer-Employee Dynamics

With benefits accounting for just over 31% of an employee’s total compensation package, employers have to leverage their employee benefits programs to attract and retain employees.

No one can be everything to everyone, but TPAs can achieve growth by offering strategic benefit options to help employers align with changing dynamics in the employer-employee relationship. The following types of benefit accounts help address many of the employee expectations described above while also keeping employer costs under control.

Flexible Spending Account (FSA)

More than 30% of employers still do not offer any kind of FSA, even though these accounts are available to all employees regardless of insurance enrollment or type of insurance coverage. With the addition of Carryover privileges, FSAs no longer present the average employee with a significant risk of losing unused funds.

In addition to providing a substantial tax benefit to employees, FSAs provide payroll tax savings to employers on the amount employees set aside. With employer matching at 7.65%, each employee contributing the 2023 annual maximum of $3,050 saves the employer $233.33 annually in payroll taxes. Add to that the dependent care FSA with an annual maximum contribution of $5,000 in 2023 and the employer could save up to another $382.50 annually per participant.

Health Savings Account (HSA)

Through its combination of investment and tax-saving features, HSAs can simultaneously benefit employees in terms of physical, mental, and financial health both currently and in the future. Now is the time for employers who have not been seeding HSAs to begin doing so.

About three-fourths of employers contribute to employee HSAs, with most (60.2%) basing the dollar amount on the employee’s coverage level.33 The most common annual employer contribution is between $500-$1,000 (34.8%), with contributions above $1,350 (31.9%) a close second. The most common frequency is per-pay-period contributions (41.3%), with front-loading at the start of the plan year (22.3%) coming in second.

Employers realize payroll tax matching savings on HSA set-asides as well. Each employee contributing the 2023 family-coverage maximum of $7,750 saves the employer $592.88 in payroll taxes.

Individual Coverage Health Reimbursement Arrangement (ICHRA) or Qualified Small Employer HRA (QSEHRA)

An ICHRA or QSEHRA can help employers who are challenged by group plan cost increases or have not sponsored a group health plan at all in the past. These plans provide reimbursement for individual health coverage employees acquire on the open market (including the healthcare marketplace).

According to the HRA Council, fewer than 2,500 employers offered ICHRAs in 2022, but that represents a growth of nearly 350% over 2020 when the accounts first became available. QSEHRA adoption grew by 70% between 2020-2022. On average, ICHRA/QSEHRA adoption combined actually doubled across all 50 states between 2020 and 2022.

Nearly six in 10 employees accept an ICHRA or QSEHRA when offered one by their employer, a rate approaching that of traditional employer-sponsored group health plans. Although QSEHRAs can only be utilized by companies with 50 or fewer full-time employees, nine out of 10 companies offering ICHRAs in 2022 had 20 or fewer employees.

Lifestyle Spending Account (LSA)

LSAs provide employers with unprecedented flexibility to support employee needs, including those of widely diverse workforces. Although taxable to the employee, these accounts can help underwrite a nearly unlimited variety of physical, mental, and financial well-being support.

Since LSAs are post-tax accounts with essentially no regulation, employers have wide latitude regarding how the funds can be used. In response to the changing priorities of their employees, many companies are sponsoring LSAs for the first time. Employers who already offer LSAs are expanding what the funds can be spent on. They can include additional physical activities, household expenses, education and remote-working costs, and non-traditional health expenses. (Avoid Section 223 medical expenses so to avoid triggering ERISA involvement.)

Student Loan Repayment Assistance (SLRA)

Many employees are burdened by student loan debt. According to PeopleKeep’s 2022 Employee Benefits Survey Report, 26% of Gen Z employees and 27% of Millennials consider student loan repayment assistance as “very” or “extremely” important.37

Under the CARES Act of 2020 and Consolidated Appropriations Act of 2021, student loan repayment assistance from employers up to $5,250 annually per employee is non-taxable to the employee through December 2025.

Employees who believe that management is concerned about them as a whole person –not just an employee – are more productive, more satisfied, more fulfilled. Satisfied employees mean satisfied customers, which leads to profitability.

anne m. mulcahy

former chair and CEO, Xerox Corp.