The Affordable Care Act has impacted American lives for over a decade. How has it affected the Consumer-Directed Healthcare account market?

Healthcare reform has been a topic of debate since the early 20th century. Many recent U.S. presidents have endeavored to reshape the American system in varying ways. The Affordable Care Act (ACA), which became law in 2010, is the most comprehensive reform since the 1960s. Implementation has had wide-reaching effects on the healthcare and insurance industries. In particular, the Affordable Care Act has significantly impacted the Consumer-Directed Healthcare (CDH) market.

Despite many obstacles, or perhaps because of them, the CDH account market has grown significantly year-over-year as the ACA has evolved. Will such growth continue? And how can employers, brokers and third-party administrators (TPAs) take advantage of this growth?

When was the ACA enacted and why?

Healthcare reform has been a topic of debate since the early 20th century. Proponents of universal systems view healthcare as a right, not a privilege. Many also believe that providing more access to preventative measures will serve to minimize the resources that patients will consume in the long run.

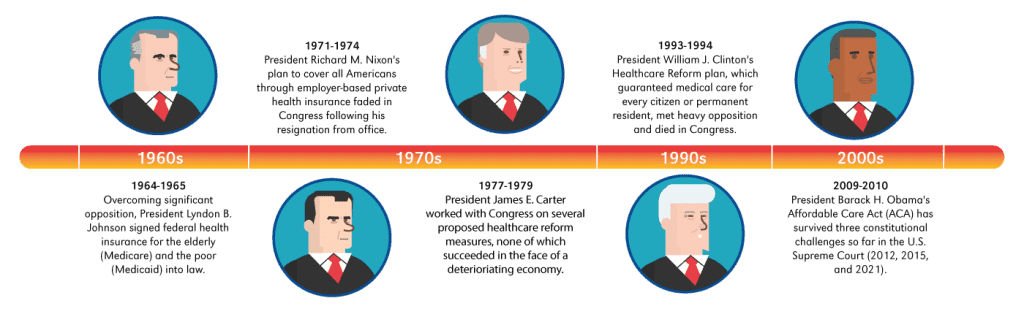

Several U.S. presidents have tried to establish some form of universal or government-assisted healthcare. During the Johnson Administration, Congress enacted the Social Security Amendments in 1965 which created Medicare and Medicaid. In subsequent years, the Nixon, Carter and Clinton administrations all attempted to pass some degree of universal healthcare with little success.

Contemporary Timeline of Presidential Healthcare Reform

Finally, the Obama Administration succeeded in passing a wide-ranging reform package. Signed into law in 2010, the Affordable Care Act, also referred to as “Obamacare,” is the most comprehensive healthcare reform to be enacted since Johnson’s Social Security Amendments. The ACA prioritized three major goals:

- Ensure that as many Americans as possible have access to healthcare coverage

- Improve the quality of healthcare provided to insureds

- Reduce the overall costs of healthcare

However, implementation of the ACA as enacted has had wide-reaching effects on the healthcare and insurance industries. In particular, the ACA has significantly impacted the CDH account market in mostly positive ways as it has evolved.

Potential Problems and Opposition

Since its inception, the Affordable Care Act has faced substantial opposition from various groups who consider its potential impact to range from merely ill-advised to utterly harmful to society, the economy, or both.

Many people in the general public strongly opposed the ACA. Subsidization of insurance coverage for those who cannot otherwise afford it would have to come from those who can. This has been viewed as an unfair redistribution of resources. Many worried that their premiums would increase to subsidize the increased healthcare usage and costs driven by the sick and elderly. Finally, some saw the mandates of forcing people to acquire coverage who didn’t want it as a major overreach of federal power.

And finally, the health insurance industry saw it as a huge problem for their business model. If employees left their employer-sponsored plans and moved to this government-sponsored model, what would happen to their companies? Would the amount of covered lives be reduced? How badly would those reductions cut into profit margins? If too many lives were “lost” to the government program, how many businesses such as benefits brokers and third-party administrators (TPAs) would survive?

So how did it really affect brokers and TPAs? To understand that, let’s look at a brief history and what has happened post-ACA.

Third-Party Administrators Through the Years

TPAs have been around in some form since as early as 1933 due to the need for managing and servicing pension plans. As health insurance and benefits expanded over the decades since, managing those benefits has become more complicated and time-consuming. With the addition of Social Security and Medicare taxes and rising costs for employer-sponsored plans, the amount of time and money that employers had to spend on administration became overwhelming. More and more employers turned to TPAs to balance the task of providing benefits to employees while also keeping costs within budget.

With enactment of the Affordable Care Act, health insurance premiums were expected to rise, as is often the case when the healthy are subsidizing care for the less healthy. Employers had to weigh the pros and cons of non-compliance penalties, high-cost insurance programs, and passing costs on to employees in the form of increased cost-sharing. To illustrate just how complicated ACA’s coverage and provision requirements have become for business owners, let’s look at a few examples.

ACA Coverage and Tax Provisions

Small Businesses

Small businesses (50 or fewer full-time or full-time-equivalent employees) have been affected by the ACA nearly as much as individuals (see Healthcare.gov for more information).

Some of the more recognized initiatives include:

- Employers must provide employees with a written Summary of Benefits and Coverage (SBC).

- Employers wanting to provide health coverage for their employees now have multiple options. For example, the Small Business Health Options Program (SHOP) marketplace for employers with 100 or fewer employees (full-time or full-time equivalent) helps businesses access affordable employee health and dental coverage.

- Medical Loss Ratio (MLR): Insurance companies that spend less than 80% of a plan’s premium dollars on medical care must rebate to the policyholders. For group health plans, this is the employer, which then must allocate a pro-rata share of the rebate to the covered employees who paid a portion of the premiums collected. In 2019, insurance companies returned $1.37 billion in MLR rebates to policyholders.

Large Businesses

Prior to the Affordable Care Act, larger employers (more than 50 full-time or full-time equivalent employees) could decide what health benefits to offer, if any. Post-ACA, they are now mandated to offer insurance benefits with a minimum level of coverage, in addition to all the requirements placed on smaller businesses (more information on these mandates can be found on IRS.gov).

Some of the better-known requirements for large businesses include:

- Larger employers must offer affordable Minimum Essential Coverage (MEC) to employees and their dependents or potentially owe an employer shared responsibility payment.

- Self-insured employers must pay a fee each year to the Patient-Centered Outcomes Research Trust Fund (PCORI). Due to expire in 2019, this fee was extended by the Consolidated Appropriations Act (CAA) through 2029.

- They must withhold and report an additional 0.9 percent Medicare tax on employee wages or compensation exceeding $200,000 annually.

- They must report the value of the health insurance coverage provided to each employee on their W-2 forms.

- They must file an annual return reporting whether and what health insurance was offered to their employees.

Amendment and Repeal Efforts of The Affordable Care Act

Because of the opposition and problems (or potential problems) that the Affordable Care Act has generated, many see it as imposing unnecessary fiscal and financial burdens. After taking office in 2017, President Donald J. Trump used his first Executive Order to delay further ACA provisions and requirements deemed to impose fiscal burdens on stakeholders. While the Trump Administration did not entirely eliminate the ACA, significant changes were made. The enrollment period for ACA healthcare marketplaces was shortened and all efforts to recruit enrollees were pared back. The requirement to have health insurance (the “individual mandate”) was removed and the associated tax penalty was reduced to zero.

However, the program is now being managed by the administration of President Joseph R. Biden, who continues to propose changes. This continuous evolution of the ACA makes it difficult for stakeholders to keep up and stay compliant, especially in the CDH space. Let’s look at how the ACA has complicated, yet also improved, CDH over the past 11 years.

Consumer Directed Healthcare Before and After The Affordable Care Act

In the late 1960’s, American inflation caused the cost of health benefits to increase. In response, the industry instituted cost-reduction measures such as co-pays and deductibles. Employers sought lower-cost plans with reduced benefits. To provide some relief, the 1970’s saw the introduction of CDH initiatives including the creation of Health Reimbursement Arrangements (HRAs) and Flexible Spending Accounts (FSAs).

Health Reimbursement Arrangements (HRA)

HRAs were one of the earliest examples of CDH. Employers set up accounts that employees could use to help pay for certain healthcare products and services, mostly ones for which employee cost-sharing was increasing as companies sought to control benefit costs. Employers had free reign to determine what the funds could be used for, but they generally covered deductibles, co-pays and co-insurance.

Then came the Affordable Care Act, which affected HRAs particularly in two ways:

- HRAs had to be linked to the group health plan. Employers could no longer provide an HRA to help an employee acquire health insurance on the open market or pay for healthcare expenses if not enrolled in the company group insurance plan.

- Employees were not eligible for the premium tax credit if their employer-sponsored plan was affordable and provided MEC. Minimum value could be required at the employer level, and HRA contributions did not count toward the affordability or minimum value requirements.

The most problematic provision was arguably the inability for employers to sponsor a standalone HRA for healthcare expenses or premiums. This has been alleviated with the passage of three new types of HRA accounts:

- Qualified Small Employer HRA (QSEHRA), created in 2016, allows small employers to provide up to $5,300 for individuals and $10,700 for families (annual limits for 2021) to use in paying major medical healthcare insurance premiums and expenses. Dental and vision are not included.

- Individual Coverage Health Reimbursement Arrangement (ICHRA), created in 2019, is similar to QSEHRAs except they can be offered by companies of all sizes and have no monetary limits. Most ICHRA plans are set up to provide employees with funds to help buy their own health insurance policies.

- Excepted Benefit Health Reimbursement Arrangement (EBHRA), also created in 2019, can be used for “excepted benefits” only (such as dental or vision insurance) by employers of any size, with a maximum of $1,800 a year.

More information about HRAs can be found on Thomson Reuters/Westlaw.

Flexible Spending Accounts (FSA)

FSAs were created as part of the Revenue Act of 1978 to enable employees to contribute to CDH accounts and get tax benefits for those contributions. When the ACA was enacted, two provisions dramatically affected FSA accounts:

- Over-the-counter (OTC) care products were removed from the list of eligible expenses. ACA section 9003 specified that the only OTC products that could be reimbursed without a letter of medical necessity were non-medicated items (such as bandages or reading glasses), OTC forms of insulin, and items for which the individual had a valid prescription. This was a major concern for FSA account holders, especially those who often went on OTC “shopping sprees” each plan year to avoid losing funds under the “use it or lose it” and “grace period” rules for FSA accounts.

- Under ACA section 9005, the annual amount an employee could elect and contribute to an FSA was set at $2,500 starting in 2013. (This annual amount is reviewed each year in response to inflation and has grown to $2,750 as of 2021.) Prior to the ACA, the limit was set by each employer, with no mandated maximum, and most companies allowed employees to elect and contribute up to $5,000 annually.

These limitations were made primarily to increase tax revenues in order to help pay for some of the other ACA provisions.

Health Savings Accounts (HSA)

HSAs have been around since 2003. Persons enrolled in a qualifying High Deductible Health Plan (HDHP) can use their HSA to set aside funds for IRS-approved medical and healthcare expenses. These accounts are restricted to qualified expenses in the same manner as FSA accounts. However, they also serve as a type of savings account, as the account holder owns the account, can roll over the balance from year-to-year, and can take it with them if they leave the company, and in many cases, invest the available balance.

When ACA was enacted it made these changes to HSAs:

- OTC eligibility was removed for HSAs, just as it was for FSAs.

- ACA doubled the penalty for distributions (withdrawals) made for non-medical purposes.

- HSA-qualified health plans had to start covering preventive services with no cost sharing or deductible requirements.

- Individual state mandates presented challenges to HDHPs, and, in turn, HSAs.

Yet … The CDH Market is Thriving

Despite the obstacles thrown at it, or perhaps because of them, the CDH account market has grown significantly year-over-year since the ACA was first enacted and as it has evolved.

HRAs:

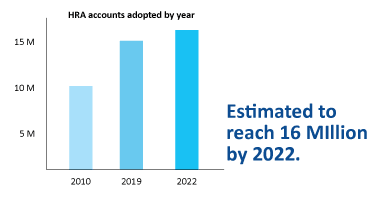

In 2010, there were an estimated 10 million HRA accounts in force. By 2019, that number had surged to 15 million, with the market expected to expand to nearly 16 million by 2022.

FSAs:

In 2010, 39 percent of all workers had access to a healthcare FSA. On average, 37 percent of workers who were offered an FSA chose to participate, with an estimated 18 million FSA accounts in force and an average annual contribution of $1,420. By 2019, the total number of FSA accounts, including healthcare, dependent, and limited purpose, had risen to 30.2 million. By 2022, the market is expected to grow further to 32.6 million accounts.

HSAs:

In 2010, 25.3 percent of those under age 65 who had private health insurance were enrolled in an HDHP, including 7.7% who had a CDHP (HDHP + HSA account). By 2017, enrollment in CDHPs had nearly quadrupled, to 31.9 percent of commercially insured individuals. By the end of 2020, there were nearly 30 million HSA accounts with an asset value of $82 billion. Almost $24 billion was being invested, a 52% increase over just one year prior.

Conclusion

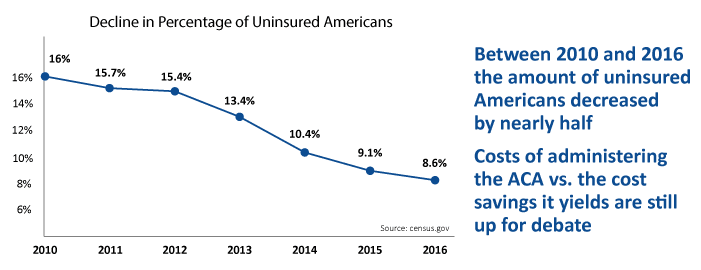

While the ACA reduced the number of uninsured Americans to an all-time low of 9 percent by 2016, its ability to lower costs, improve quality, and result in a healthier population overall is still up for debate. Factors remaining at issue include whether the cost of administering ACA regulations, and the effects of those regulations on various sectors of the economy, balance favorably with cost savings that may ultimately be created.

Partisan conflicts triggered by the ACA and numerous efforts to dial it down, if not eliminate it entirely, are taking their toll. However, the Biden Administration has expressed full support for the ACA. Short of one or more U.S. Supreme Court rulings to repeal all or a major part of its provisions, the ACA is expected to remain in force and continue evolving for many years to come.

In the case of CDH accounts, the impact of the ACA as it has continued to play out has been positive. FSAs, HRAs and HSAs are thriving, with consistent growth over the past 11 years and no slowdown in sight. Because of continuing market growth and the evolution of ACA regulations and requirements, it’s never been more difficult for employers to manage the health and wellness assistance they provide their employees. That’s why there’s never been a better time to consider retaining the services of a benefits broker and TPA to help make sure your business remains informed and compliant.

Sources

- Kaiser Family Foundation, Summary of the Affordable Care Act, April 25, 2013

- Healthcare.gov, How the Affordable Care Act Affects Small Businesses.

- Center for American Progress, Affordable Care Act Repeal by State, March 2. 2020

- IRS.gov, Affordable Care Act Tax Provisions for Large Employers.

- DataPath, Inc., What is PCORI and What Does It Do?

- Thomson Reuters/Westlaw, Guidance Addresses the ACA’s Impact on EAPs, HRAs, and Health FSAs, September 17, 2013.

- FSAStore.com, How We Got Here: A Timeline of Tax-Free Healthcare.

- Los Angeles Times, A Hidden Tax in Obamacare, May 31, 2013.

- HealthInsurance.org, Can I Still Have An Individual HDHP and an HSA?, May 17, 2021.

- Center for American Progress, 10 Ways the ACA has Improved Health Care in the Past Decade, March 23, 2020.

- Aite Novarica, Consumer-Directed Healthcare: Sizing the Market, February 8, 2020.

- Aite Novarica, HBA Market Forecast: A Closeup on FSAs, HRAs, ICHRA, and COBRA, October 21, 2020.

- Congressional Research Service, Healthcare Flexible Spending Accounts, June 13, 2012.

- Centers for Disease Control and Prevention, Health Insurance Coverage: Early Release of Estimates from the National Health Interview Survey, 2010.

- Health Care Cost Institute, Consumer-Directed Health Plan Enrollment Rises in All Cities Over 10 Years (2008-2017), June 10, 2020.

- Devenir Research, 2020 Year-End HSA Market Statistics and Trends, Executive Summary, March 3, 2021.

- National Center for Health Statistics, Health Insurance Coverage: Early Release of Estimates from the National Health Interview Survey, 2018.

About the Company:

For 40 years, DataPath has been a pivotal force in the employee benefits, financial services, and insurance industries. The company’s flagship DataPath Summit platform offers an integrated solution for managing CDH, HSA, Well-Being, COBRA, and Billing. Through its partnership with Accelergent Growth Solutions, DataPath also offers expert BPO services, automation, outsourced customer service, and award-winning marketing services.