DataPath Financial Services, Inc. (DFS) is proud to offer you a Health Savings Account (HSA) through Summit, the nation’s most service-driven, all-in-one HSA solution. In Summit, you have account management, banking, and investments in a single platform.

Per IRS regulations, HSA funds must be held by an authorized Trustee or Custodian. DFS is honored to serve you in that role. You can be assured you will receive personal service, attention to detail, and the highest standards of professional excellence from DFS. We look forward to working with your Plan Service Provider to provide you HSA services that go beyond a simple bank account and put you in control of your health care choices. If you have questions regarding HSAs, please email fiops@dpath.com.

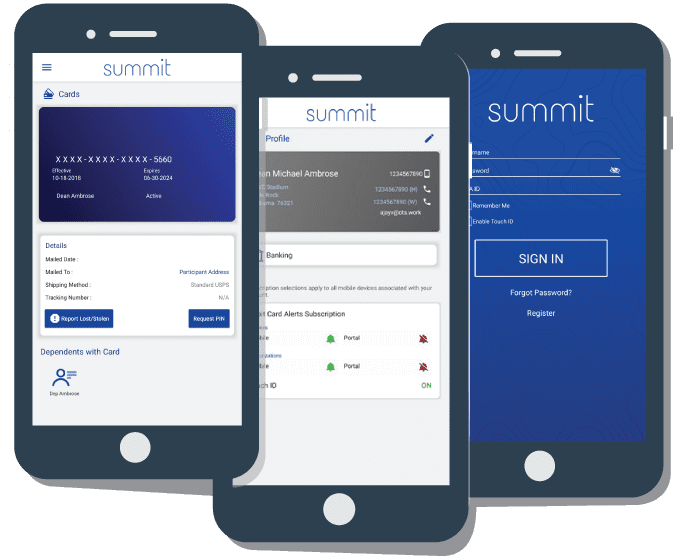

Complete Account Management At Your Fingertips

One of our goals is to empower you with the tools you need to make wise and informed decisions about your healthcare. A secure web portal gives you 24/7 access to:

- Account Balances and History

- Online Claims Storage Through the patented ClaimsVault®

- Deposit & Withdrawal Capabilities

- Up-to-Date Payment History

- Account Statements

- Investment Options

- Important Forms & Documents

HSA Transfer or Rollover from prior custodian to Summit

Current Account Owners need to complete the HSA Transfer Request Form to request an HSA Transfer or Rollover from prior custodian to DFS. Print, complete and submit by mail, email or fax to address details list on form.

Savings and Investments

To maximize your long-term savings, your HSA funds are placed in one of two types of balance accounts.

Savings

This account is held in an FDIC Insured Savings Account and earns interest as shown in the “Earning Rates Schedule” section on this page.

An added feature of your savings account is the option of using the Summit MasterCard® debit card. Your card, if made available by your PSP and elected by you, is directly connected to the funds in your savings account. This option makes accessing your HSA funds as easy and convenient as a swipe of the card.

One of the key goals of an HSA is the long-term savings of your money, and you may need access to those funds at any time. Through DataPath Financial Services, your HSA funds are readily available if the need arises and can be accessed using the Summit MasterCard® debit card or by check and ACH transfers. Please contact your PSP for assistance.

Investments

There is a second, and optional, balance account component of DFS's HSA program. Investments, if made available by your PSP, and elected by you, allow you to invest funds into a variety of Mutual Funds. Please see the below "Investments" section for more information.

Investments

The Summit HSA Investment Program offers qualified account holders a diverse range of investment alternatives to choose from, along with five professionally managed model portfolios that support varied investment objectives and risk tolerance. This investment program is intended for long-term investments only and not to be used for short-term cash availability. Click here to view a list of available funds.

Professionally Managed

DataPath Investment Advisors, Inc. (DPIA) is the investment advisor for DataPath Financial Services and Summit. DPIA screens, selects and monitors the investment options and constructs and maintains the model portfolios. DPIA is a related entity of DataPath Financial Services and DataPath, Inc.

What model portfolios are offered?

The model portfolios, listed from lowest to highest risk levels, include:

Conservative Growth Portfolio - For the Investor who seeks to allocate a large percentage of their portfolio to lower-risk securities such as fixed-income securities. The main goal of a conservative portfolio is to protect the principal value of your portfolio. That is why these models are often called “capital preservation portfolios.” Even if you are very conservative and are tempted to avoid the stock market entirely, some risk exposure in selected funds can help offset inflation. Suggested time horizon for this risk allocation is at least 5 years.

Moderately Conservative Growth Portfolio - For the Investor who seeks to preserve most of the portfolio’s total value but is willing to take on some risk for inflation protection. A common strategy within this risk level is called “current income.” This includes securities that pay a higher level of dividends. The suggested investor’s time horizon least 5 to 8 years.

Balanced Growth Portfolio - For the Investor who seeks a balance between preservation of account value and portfolio risk. The goal is a near even split between low risk fix-income securities and higher-risk growth securities. This strategy also includes securities that pay a higher level of dividends. The Investor’s time horizon for investing should be medium term or greater than 8 years.

Moderately Aggressive Growth Portfolio - For the Investor who has a longer-term strategy (greater than 10 years) and willing to take a medium to higher level of risk to achieve portfolio growth, while still diversifying the portfolio by including fixed-income securities. The strategy is often called “capital growth” strategy. To provide diversification, the portfolio includes fix-income securities.

Aggressive Growth Portfolio - For the investor with a long-term investment strategy (greater than 12 to 15 years) and willing to accept their portfolio value can fluctuates widely from day-to-day. Your main goal is to achieve long-term growth of capital. The strategy of an aggressive portfolio is considered a “capital growth” strategy. To provide diversification, investors with aggressive portfolios usually add some fixed-income securities.

What are the benefits of investing your HSA funds?

Many Americans will depend on personal savings and investments during retirement. Utilizing your Health Savings Account as a long-term investment vehicle is an excellent way to add to your retirement strategy. Whether you are a current HSA account holder or you are just now enrolling, it’s a good idea to consider investing some of your account funds. Here are just a few reasons why:

- Tax-Free Investments: All contributions and earnings in your HSA are considered tax-free by the IRS. They will not be taxed unless you withdraw them for non-medical reasons.

- Portability: There is no use-it-or-lose-it rule associated with HSAs. HSAs are owned by the account holder and roll over year after year. Even if your employment status changes, the money in the account is yours to keep.

- Flexibility: You can change the amount you want to invest and the way the funds are invested. Plus, you can always access the money in your account if the need arises.

- Multiple Investment Options: Pick from one of four investment models or create your very own custom investment portfolio.

Ask your plan service provider about your investing options!

Account Owner's Disclosure

Interest*

The interest rate applicable to the entire balance in your HSA Deposit Account on any given day will depend on which of the specific balance ranges your daily Account balances falls within on that day:

Daily Balance | Rates as of 1/1/2024 |

|---|---|

$50000 or higher | 0.650% |

$35000 to 49999.99 | 0.400% |

$15000 to 34999.99 | 0.250% |

$7500 to 14999.99 | 0.100% |

$500 to 7499.99 | 0.050% |

$0 to 499.99 | 0.000% |

*Interest rates are subject to change at any time. Fees may reduce earnings.

Additional Banking Services**

You are responsible for the payment of the fees as set forth below. However, in some instances, the fees, or a portion thereof, may be paid by an Employer or Plan Service Provider. To the extent the fees are not paid by another entity, we will deduct the fees from your Deposit Account. These fees are subject to change by us at any time (including, but not limited to, the expiration of your High Deductible Health Plan), upon notice to you as required by applicable law.

Monthly Investment Option (Investment Threshold is $1,000) | $3.00 |

Deposit Return unpaid | $15.00 |

Overdraft/NSF per item | $22.50 |

Debit Card Reissue Fee (per card) | $5.00 |

Withdrawal by paper check | $3.00 |

Close Account Fee | $25.00 |

Balance Transfer Fee (Trustee-to-Trustee) | $15.00 |

Stop Payment per item | $25.00 |

Wire Transfer (Individual or Employer) | $15.00 |

Monthly Statement by mail | $3.00 |

Copy of Check, Statement, 1099, 5498 | $5.00 |

Corrected IRS Filing Fee (non-banking error) | $10.00 |

** These are retail rates charged directly to the Individual HSA by the Custodian.

Included with your Summit HSA Account:

Online Account Access | No Charge |

Online Monthly Savings Statements | No Charge |

Online Monthly Investment Statements | No Charge |

Regular Distributions by EFT | No Charge |

Annual Statement by Mail | No Charge |

Form 1099-SA & 5498-SA by Mail | No Charge |

- Summit HSA deposit account offered by DataPath Financial Services, Inc. (DFS).

- Summit HSA Savings Account is FDIC-insured and can include U.S. government and government agency debt obligations.

- Summit HSA Investment Account not guaranteed by Custodian or insured by FDIC. May lose value.

- For more details regarding the general terms and conditions that apply to your HSA, please see the Custodial Account Agreement for Health Savings Accounts.

How We Calculate Account Earnings

Each month your interest earned is determined by the daily balance and daily rate for each day of the month using the above rate schedule. The daily rate is multiplied by the principal in the account for each day to get the daily interest earned. The sum of each day’s interest becomes the posted deposit earnings for the month. Interest begins to accrue no later than the business day we receive credit for the deposit of non-cash items (e.g. checks). Interest is compounded and posted to your account monthly. The interest rate and APY is based on your account balance.

How We Handle Interest Upon Account Closure

If the account is closed on the 1st day of the month, there are no earnings accrued to post. The account is closed and the full balance less pending fees, distributions, or card authorizations, will be distributed. If the account is closed after the 1st day of the month, the system will determine the interest accrued based on the number of days the account was active during the month. This amount is automatically posted to the account prior to the final distribution.

Minimum Deposit for New Accounts

No minimum balance or initial deposit requirements apply to this account.

Overdrafts

Overdrafts resulting from checks or ACH transactions will be charged an overdraft/NSF fee directly to the health savings account (see above fee schedule). Overdrafts caused by debit card transactions will not be charged an overdraft/NSF fee. Overdrafts caused by investment purchase that results in a transfer from savings, will not be changed an Overdraft/NSF fee. ATM transactions are not allowed on this account.