Summit’s ability to handle anything related to ARPA was an A+ job! DataPath helped us make sure we had all of our T’s crossed.

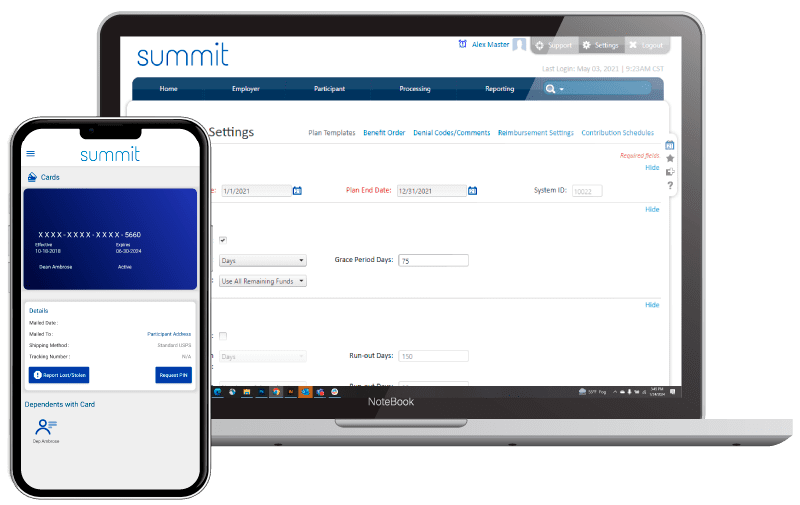

Developed specifically with TPAs in mind, DataPath Summit streamlines benefits administration for FSAs, HSAs, HRAs, ICHRAs, EBHRAs, QSEHRAs, Lifestyle Spending Accounts, Dependent Care accounts, Transit and Parking accounts, COBRA, Retiree Billing, and Direct Billing.

Summit also includes integrated financial processes such as debit cards, electronic payments, and investments.

Watch this short video to learn more.

Manage COBRA, retiree, and direct billing

Administer FSAs, HSAs, HRAs, Transit and more

Manage accounts for employee well-being

Quick, Easy Account Setup

Powerful Data Exchange

Automated, On-Demand Reporting

Secure Broker Access

Business Process Outsourcing (BPO) Services

Mobile App

Summit’s ability to handle anything related to ARPA was an A+ job! DataPath helped us make sure we had all of our T’s crossed.

DataPath has been a big help to Comparative Solutions. We've always found them to be knowledgeable and responsive. Whatever challenge might come up, we know they'll have our backs.

Watch a FREE Demo!