Employers may be switching to HDHPs and HSAs, but there are still some barriers to employees embracing the change.

A lack of understanding and confusion about cost shifting are among the factors in non-adoption. TPAs and brokers, as front line experts for consumer directed healthcare, have the tools and knowledge to deliver greater HSA adoption for their clients. When they do, it’s a win for everyone.

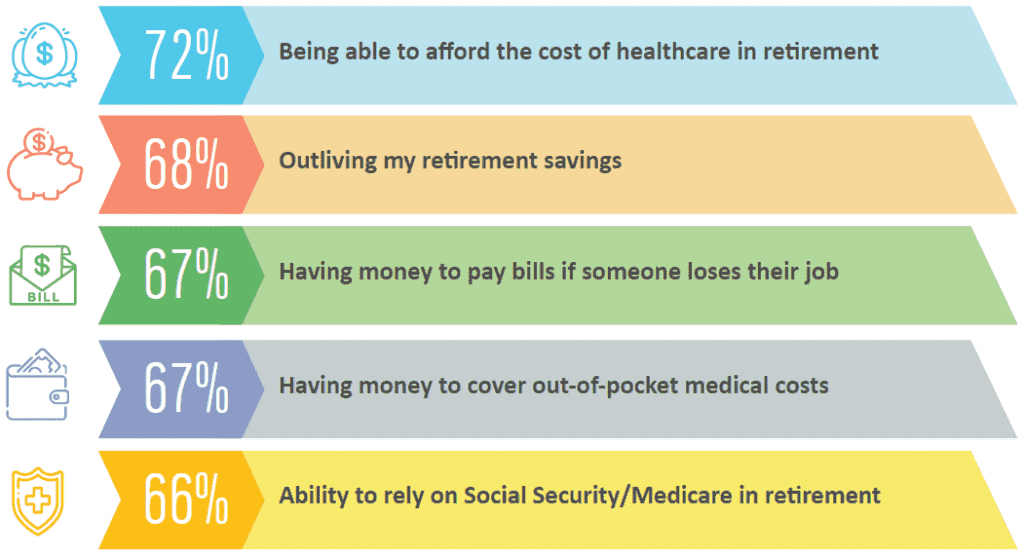

Financial Stressors for American Workers – Healthcare and Retirement

Of the top five sources of financial stress among the American workforce, being able to afford the cost of healthcare in retirement ranks number one. Nearly three out of four employees (72%) admit worrying about the issue. Second in line is the prospect of outliving their retirement savings (68%), and a close fourth is whether they will have the funds needed to cover out-of-pocket medical costs (67%) in the near term.

What are employees’ top 5 sources of financial stress?1

What tools are available for third party administrators and benefits brokers to help ease these concerns?

There are two benefit accounts that employees are familiar with – the 401(k) and Health Savings Account (HSA) – that are designed to soothe these financial worries.

A Retirement Savings Solution

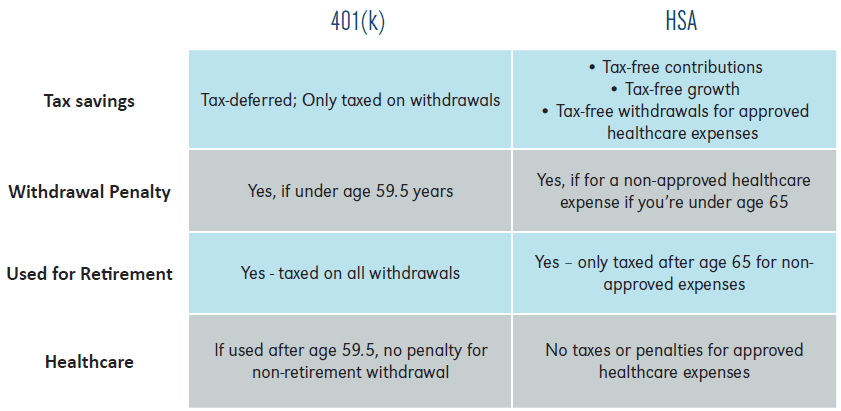

Most people these days understand what a 401(k) is – a financial tool to help people save for retirement. In fact, 65 percent of private sector workers over age 22 are employed by a company that offers a 401(k).2 Once people reach age 59.5, they can start withdrawing the money for any reason. There are a few caveats, though.

First, all withdrawals are taxed – healthcare, retirement, or otherwise. Second, any withdrawal before meeting the minimum age requirement results in a 10 percent early withdrawal fee in addition to being taxed. While a 401(k) is an excellent tool for retirement purposes (a long term solution), it is somewhat limited in actual usability.

A Multi-faceted Solution for Healthcare and Retirement

There is another option – a high deductible health plan (HDHP) coupled with a Health Savings Account (HSA). Given the cost of healthcare (even with Medicare in retirement), people need a more robust option than a 401(k). Consider that 68 percent of people are worried about outliving their retirement savings. This is troubling, especially considering that 64 percent of Americans are now expected to retire with less than $10,000 in their retirement savings accounts.3 An HDHP with HSA could be the right combination for remedying those financial, healthcare, and longevity concerns.

What is an HDHP?

Initially conceived in 2004, a high deductible health plan lowers the cost of monthly premiums while raising the cost of the deductible. It essentially lowers the month-to-month costs of healthcare plans, only adding in costs when people need their healthcare.

Paired with an HDHP is the Health Savings Account. An HSA is a tax-advantaged savings account that allows people to put money aside tax-free to pay for approved healthcare expenses down the road. In addition, HSA owners enjoy tax-free interest and investment income and tax-free withdrawals for approved expenses. Then after age 65, the HSA can be used for any reason without penalty (it is only subject to taxation).

401(k) vs Health Savings Account (HSA)

HSA Facts and Concerns

In June 2019, there were over 26 million open HSA accounts, according to Devenir – up 12 percent over June of the previous year. Since 2015, HSAs have grown from 16.5 million accounts to 26.26 million – an increase of 57 percent.4 Seventy percent of all employers now offer an HDHP option. This is good news for employees, employers, TPAs and brokers. However, there are still boundaries to HSA adoption by employees and as more employers switch to high deductible health plans, growth has slowed. TPAs, brokers, and employers need to look at what drives employee decision-making and provide tools for an improved customer experience.

Employers weighing whether to offer an HSA-eligible HDHP should consider that half of all employees say better benefits are key to thriving, while 29 percent of employees say they would stay with their current employer indefinitely if offered better benefits (ranking second only to being offered a higher salary).5

What factors are preventing employees from adopting the HSA?

- Lack of education – Tax-advantaged healthcare benefits are notoriously hard to understand. In fact, nearly two-thirds (64%) of healthcare industry professionals report that consumer understanding of HSAs, Health Reimbursement Arrangements (HRAs) and Flexible Spending Accounts (FSAs) is mediocre. Over one quarter (28%) of those same professionals rate it as poor. Of the three account types, HSAs are pegged as the most difficult to understand.6

- Misconceptions – Many people believe that an HSA is simply a tax benefit for high-income employees.

However, the median household income for HSA account owners is presently $57,060, and two-thirds earn less than $75,000 annually.7 Compare that to the average household income in the United States, which was $63,179 in 2018.8 - Lack of understanding – More than half of employees do not recognize the advantages of enrolling in an HSA, according to a study by Willis Towers Watson.9

- Personal finance – The fear of cost shifting affects how employees view HDHPs when compared to other health insurance options. Nearly 1 in 4 employees do not think they have enough money to contribute to an HSA.10

HSA Talking Points – Keys to Increased Adoption

When discussing the value of an HSA with HDHP, certain talking points are vital. These include:

Cost-shifting

People may feel alarmed by a high deductible. However, promoting the value of lower premium expenses up front and the savings associated with HSAs can ease those fears.

Tax savings

HSAs offer a “tax trifecta:” tax-free contributions, tax-free growth through investing and the interest earned on non-invested balances, and tax-free withdrawals for eligible healthcare expenses.

Medical spending account

People with recurring health expenses may not see HSAs as a viable option. However, it can help people budget better for their healthcare needs. Plus, emphasizing the tax savings (pre-tax contributions and withdrawals) as compared to just paying out-of-pocket can help sell the idea.

Medicare supplement

While Medicare covers many healthcare costs for retirees, people often have to cover some portion out of pocket. HSA funds used for qualified healthcare expenses remain tax-free in retirement.

Rollover

HSAs are unique among tax-advantaged healthcare benefit accounts in that any unspent balance rolls over from year to year with no limitation on the amount. Compare that to FSA and HRA balances, which can be lost year after year if not used. HSAs encourage saving and erase concerns about loss of funds.

Portability

An HSA is yours for life – no matter your employment status or health insurance coverage. You can use the money for qualified healthcare costs whenever you need it.

Retirement savings

After age 65, HSAs can be used for any type of expense without penalty. In cases where HSA funds are withdrawn for non-healthcare spending, the amount is taxed as regular income, similar to the tax treatment of 401(k) withdrawals in retirement.

Customer experience

Delivering a unified customer experience is vital. Account management, investing, education, etc. are all keys to happiness for account holders. Promoting an all-in-one HSA experience can promote adoption and ease concerns about working with multiple vendors

401(k) supplement or alternative

For people with a 401(k), an HSA can be a complimentary account. Contribute to the HSA first and use it for healthcare. Any funds that rollover are added value to the retirement nest egg.

Keys for Growing Employee Adoption of HSAs

In addition to efforts to increase employee understanding of how HSAs work and the value they present, there are several actions employers can take that are proven to significantly increase employee adoption of HDHPs and HSAs. These include:

- Employer seeding – Many employers “seed” employee accounts (make one or more employer-funded

contributions), either to provide spendable funds early in the plan year before employee contributions

have a chance to build up, or to offset a portion of the deductible over the year. Seeded amounts typically range between $300-$750 annually for employee only coverage and $700-$1,400 for family coverage.11 - Education – Employee education is a key factor for employee adoption. Simply handing out a written

description at enrollment time is usually not very effective. Different people have different learning styles. Also, the idea of facing a high deductible can lead to financial fears that result in employee unwillingness to learn more or attempt to understand the value of an HDHP. Employers who utilize a structured, year-round educational campaign using print, video, and other resources typically find that enrollment in HSA-eligible HDHPs increases significantly as a result. - Patience – Once HSAs catch on with the early adopters, they can help spread the word to other

employees. Testimonials, lunch-and-learns, and other employee forums are great ways for people to hear directly from their peers about why they are happy with their HSAs. They can also share tips and tricks for maximizing account usage. Over time, as understanding and satisfaction grows, the second and third wave employees are more likely to transition to an HDHP/HSA plan.

Conclusion

Many Americans fear that they will not have the financial means to sustain them for the rest of their lives. With healthcare costs and retirement savings as big causes for worry, employers, TPAs and benefits brokers can work together to help people. One way to assist is through HDHPs and HSAs. HSAs are more versatile for short and long-term financial stability than a 401k and offer better tax incentives. As Generation X, Millennials, and Gen Z plan for their long-term financial well-being, an HSA could be the multi-faceted tool that provides the support they need for a lifetime.

In the HSA solutions market, there are tools to help third party administrators spur HSA adoption. TPAs who offer HSA management services should consider partnering with a single solutions provider, rather than having multiple relationships with different providers. Implementing a streamlined HSA solution that offers turnkey account management, integrated investing, benefits debit card, mobile app, and a robust employee education program can set themselves up for success. It also helps deliver a better customer experience with a comprehensive “one-stop shop” for account owners.

About the Company:

Founded in 1984, DataPath, Inc. is an administrative solutions provider for tax-advantaged healthcare benefit plans including FSAs, HRAs, HSAs, COBRA and other employer-sponsored benefits. The company also created the award-winning employee education and engagement program, The Adventures of Captain ContributorTM.

Learn more at dpath.com or call (800) 633-3841.

1,5 MetLife’s 17th Annual U.S. Employee Benefit Trends Study 2019

2 CNBC, “How Many Americans Don’t Have Access to a 401k“, March, 2018

3 GoBankingRates.com, “64% of Americans Aren’t Prepared For Retirement — and 48% Don’t Care” , September 2019

4 2019 Midyear Devenir HSA Research Report

6 PLANSPONSOR, “Lack of Education Biggest Barrier to HSA Adoption“, July 2015

7 “Clearing Up Misconceptions About Health Savings Accounts,” Hoover Institution

8 United States Census Bureau, September 2019

9,11 WTW, “Financing health care in retirement“, December 2020

10 SHRM, “Workers with High Deductibles Curb Health Care Spending”